How to manage Leave Travel Allowance (LTA) or Leave Travel Concession (LTC) using odoo?

What is LTA ?

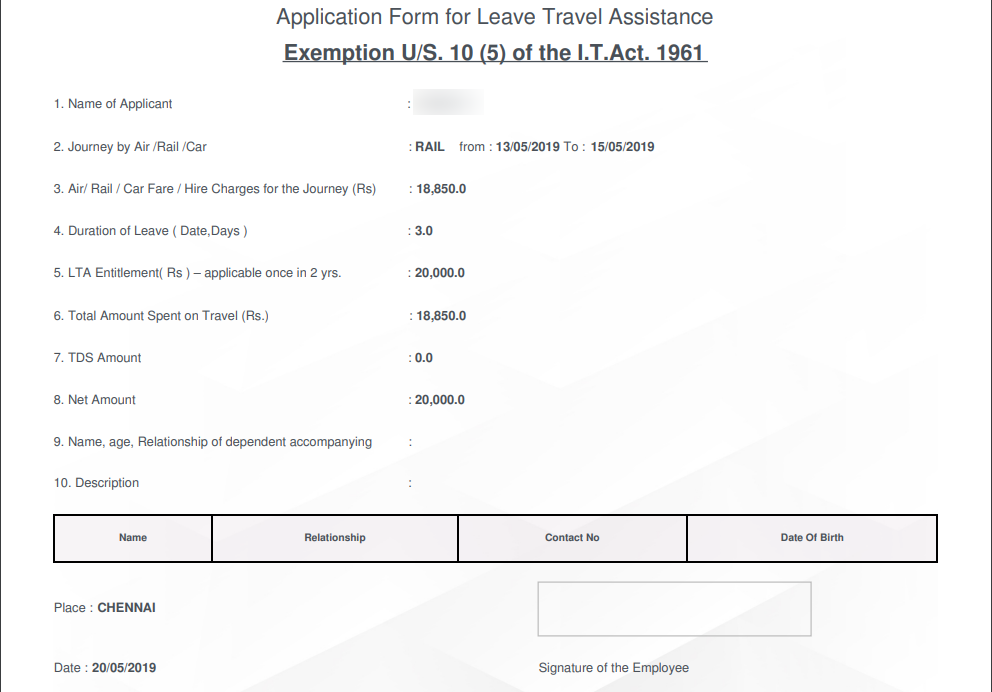

Leave Travel Allowance (LTA) is a type of allowance which is provided by the employer to his employee who is traveling on leave from the work to cover his travel expenses. LTA is an important component of the salary of the employee as it is eligible for income tax exemption as per the Income Tax Act, 1961. Under Section 10(5) of the Income Tax Act, the LTA received by the employee will not be a part of his net income of the year.

LTA is an Annual benefit which will be provided on demand or whenever they raise this request to the organization.

LTA will be provided to the employee once in two years.

The amount of LTA provided is different for different employers, depending upon the employee’s working position.

An employee can reimburse LTA in two ways

- With Travel (By submitting the travel bills) – No TDS will be deduced

- Without Travel – Since there is no bill, TDS will be deducted based on their income slab.

Employee can take LTA advance before his travel, and it will be recovered during the payment.

Employee has to share travel date, traveler’s details and location also for this claim.

LTA can only be claimed on actual travel cost. All the mediums of the travel i.e. road, rail or air are claimable under LTA. However, the employee must submit a valid proof of cost to claim the leave travel allowance.

LTA can be claimed only on the travel expense. Food or stay or any such expenses excluding travel cannot be a part of it.

LTA can only be claimed on domestic travel expenses. You can not claim LTA on the expenses incurred during the international trip (if any) of the employee.

It should be noted that the employee can not claim LTA in every financial year. LTA can be claimed only for two journeys in a block of 4 years.

As the LTA can only be claimed when the employee has been on leave from work for travelling purposes, the employee should mark that period as ‘leave’. Let’s see how to configure LTA in Odoo