9 Steps for a Successful ERP Project Go Live

Step 1: Setting up of Masters

Step 2: Opening Data Import

Step 3: Match back of Reports: – Initial Data Import

Step 4: UAT – Data Entry Operators & End User Acceptance

Step 5: Change Requests after testing the following module

Step 6: Deletion & cleanup of User Data entered during testing phase & creation of new Database

Step 7: Parallel Go Live & Match back

Step 8: Match Back of Reports

Step 9: Go Live

Step 1: Setting up of Masters

Time Taken: 3 Weeks

ERP Systems contain modules, such as Purchase, Sales, Distribution, Manufacturing, & Accounting, Human Resources, etc. The essence of an ERP system is that all its modules function in an integrated manner. Due to the integrated nature of functioning, a few master tables are referenced frequently all across the system and functions. Master Data incorporated, therefore, need to be accurate, consistent & complete.

Customer-related Data Cleanup

For a Customer, since there was historical legacy data, the 1st step was to clean up the Masters from ERP 1.0. Hence, for the following set of Masters, the below data had to be exported to an Excel sheet, unwanted inactive data had to be cleaned up and then re-imported into ERP 2.0 with the correct data.

| Organization/Accounting Schema | Business Partner |

| Warehouse & Locators | Financial Accounts |

| Unit of Measure | Account Element |

| Product | Currency Rate |

| Product Category | Conversion of Currency |

| Attribute Set | Sales Region |

| Journal | Landed Cost |

| Price List Setup | Document Type |

| Charge | Document Sequence |

| Business Partner Group | Tax Category |

| Tax Rate | Payment Term |

Forex :

- Product: There were more than 10,000 products in ERP 1.0 out of which there were only 4000 odd products. Hence, for these products, the correct Product Search key, Unit of Measure, Attribute Set Instance were corrected and final data provided.

- Business Partner: There were some 1000 odd Business Partners out of which only 800 were active. The correct Business Partners with their addresses (correct pin codes), the GST Numbers, their PAN Numbers, Import License Numbers were corrected and imported.

- Currency: All Active Currency exchange rates which were used by the Customer for Import (From Customs Department) & the payments (from payment Banks) were imported into the system.

- Document Type: Only the Current Document Base Types & Document Types were provided in an excel sheet that was imported into the system & all legacy document base types were removed.

Step 2: Opening Data Import

Time Taken: 2 Weeks

ERP Customer may want to maintain a Bill Wise history of the payments yet to be received from its Customers/Distributors/ Vendors & also the Opening Inventory. The Legacy system will be having incorrect Data of the balances to be received from the Customers/Distributors/Vendors of both the invoice & receivable amount.

Hence, the Management will have to clean up the Customers/Distributors/Vendors Invoices Data & provide the correct set of the Data in the following format.

| Date | Business Partner | Invoice Amount | Balance Amount | Whether Invoice has EMI or Not | Balance EMI Pending |

The entries will be posted and will be visible in the Trail Balance

**Important Note: In case any Invoices will have foreign Currencies, then in the Currency Rate window, based on the Currency & Exchange Rate defined, the accounting entries will be posted.

**Important Note: In the case of the Opening Inventory to be uploaded, the format for importing the records will be as follows.

| Date | Product Key | Product Name | Lot | Quantity | Cost |

Customer-related Data Imported :

- The customer had Vendor/Customers/Distributors records for the last 10 years in ERP 1.0. For their reference, Customer wanted to import the same pending documents into ERP 2.0

- These invoices were of various types.

- No Payment made/received

- Payment received/made but unallocated

- Payment received/made but the partial allocation

- Hence, while importing these data by TenthPlanet, data mismatch was reported with respect to the outstanding amount for each of these documents

- The solution hence provided by TenthPlanet was as follows:

- Only the Invoices (both purchase & sales) with the exact value as outstanding in INR balance were imported and the value was received in an excel sheet – for local Business Partner.

- Import Invoices with the exact values in foreign currency as outstanding value as on the exact Particular Date of the Invoice was provided by Customer for each Business Partner.

- The currency rates for conversion in the currency rate window were configured correctly.

- Later these imported invoices were posted in INR.

Step 3: Match back of Reports: – Initial Data Import

Time Taken: 2 Weeks

In any ERP, there will transactions which will be entered across various modules including Purchase, Sales, Storage & Distribution, Inventory handling, Accounting, etc.

For any transactions posted to the Accounting ledgers, there has to other module-level reports which will have to be matched between Accounting Reports & these module level reports.

- Stock Valuation Report vs Trial Balance

- Trial Balance from ERP vs Data Sheet

- Balance Sheet from ERP vs Data Sheet

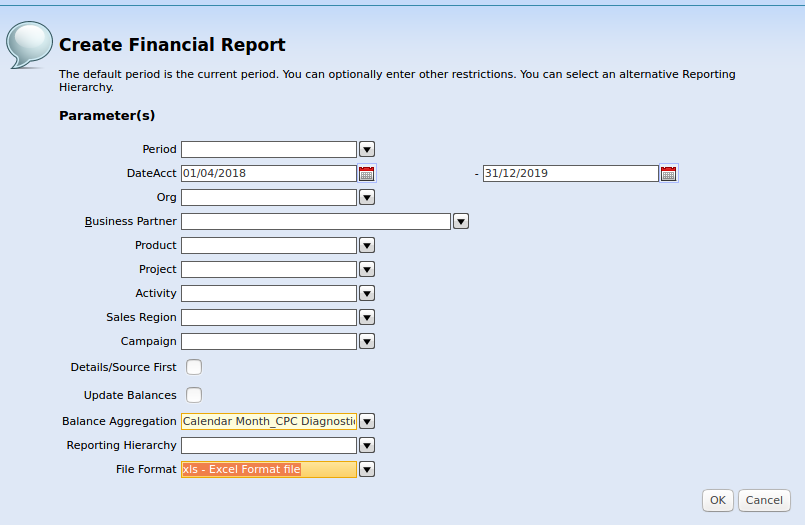

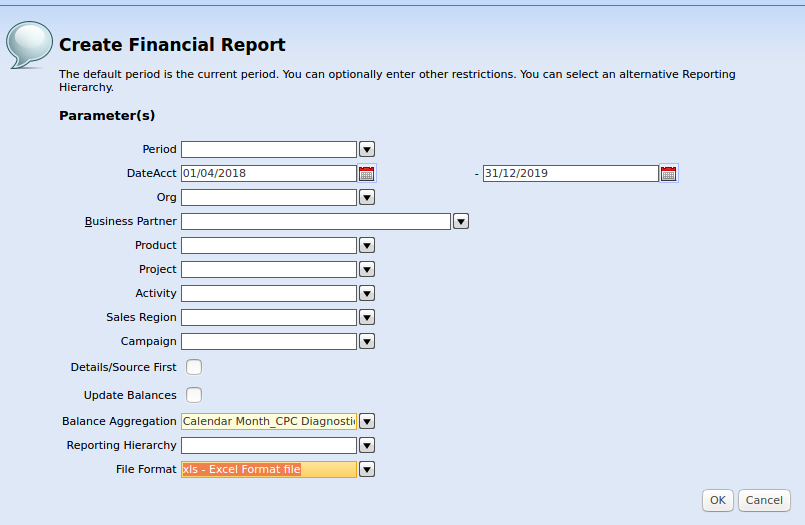

- Profit & Loss from ERP vs Data Sheet

- All Other Product related Reports

1. The Trial Balance will be now downloaded as on a Particular Date with the following data.

- a. Invoice Vendors

- b. Invoice Customers

- c. Invoice Distributors

- d. The Stock Imported

Forex:

| Particular | Debit | Credit |

| Sundry Creditors | XXXX | |

| Advance paid to Suppliers | XXXX | |

| Sundry Debtors | XXXX | |

| Advance received from Customers | XXXX | |

| Stock Acc Dr | XXXX | |

| COGS of Stock | XXXX |

2. The reversal entry for making the Trial Balance as zero for the above entry has to be completed.

Step 4: UAT – Data Entry Operators & End User Acceptance

Time Taken: 4 Weeks

This phase will focus on Unit Testing with sample data for all modules including Purchase, Sales, and Accounting, etc. A preset of test data scenarios will be provided to the Data Entry Operators for testing & verification.

The focus of user acceptance is to make sure & exhibit that the system works. The test scenarios will include AS-IS default functions of the ERP Software as well as Customized functionalities. Ideally, 1 month – 45 days transactions can be taken as a Barometer to make sure all the scenarios & functionalities are covered as part of ERP Development.

All the end-users will be identified & trained in the specific functionalities of their work. They will be given sample scenarios for testing and providing end-user training sign off. They will also be provided a User Manual & training videos for any references in the future.

Step 5: Change Requests after testing the following module

Time Taken: 1 Week

| Purchase | Inventory | Sales | Manufacturing | Accounting |

| -Requisition | – Material Receipt | – Indent | – Work Order | -Bank Payment |

| -Order | – Dispatch | -Order | -GRN | -Bank Receipt |

| -Invoice | – Warehouse Transfer | -Invoice | -BOM Issue | -GL Journal |

| -Debit Note | -Manufacturing | -Credit Note | -BOM Complete | -Report Match back |

| -Vendor Return | -Bank Reconciliation | |||

| -Customer Return | ||||

| -Material Issue/Return |

Step 6: Deletion & cleanup of User Data entered during testing phase & creation of new Database

Time Taken: 1 Week (2-5 days)

Once the End User Acceptance is signed off, a replica of the existing ERP Environment is created where all the above said transactions will be cleanup in order to keep the instance fresh for entering transactions.

This will be done through the reset accounting process the above mentioned Masters will once again be revisited and a final sign off from the End Users on the correctness of the Data will be obtained.

Note:**

Rectification entry for reversal of entries passed by uploading Bill wise Invoices of Customers & Vendors

Once the accounting entries for Sales & Purchase are posted, the Trail Balance needs to be run for the previous Financial Year (ex: 01-04-2018 to 31-03-2019).

The reversal entry for the accounting entry posted will have to be passed in order to make the Trial Balance once again “Zero” so that the Opening Data Import: (Final Trial Balance to match with the existing audited/unaudited number for the period taken as cut off.

Opening Balances in a given format (ex: CSV) to be uploaded into the system with Debit & Credit Matching.

| Particular | Debit | Credit |

| Sundry Debtors | Xx | |

| Sundry Creditors | Xx | |

| Outstanding Payable | Xx | |

| Share Capital | xx |

Step 7: Parallel Go Live & Match back

Time Taken: 2 Weeks

The ERP end-users will be passing entries in both the legacy ERP as well as the new ERP for a defined period and as & when issues are identified, will be conveyed to the ERP Vendor in order to

- Rectify errors

- Further, change requests – modules/reports

- New additional features which are must-have to Go Live

Step 8: Match Back of Reports

| S.No | List of Reports | Report Verification |

| 1 | Sales GST | Bi-Weekly |

| 2 | Debit GST | Bi-Weekly |

| 3 | Credit Note GST | Bi-Weekly |

| 4 | Purchase GST | Bi-Weekly |

| 5 | TDS Report | Bi-Weekly |

| 6 | Sales Register | Bi-Weekly |

| 7 | Purchase Register | Bi-Weekly |

| 8 | Bank Day Book | Weekly |

| 9 | Party Ledger | Weekly |

| 10 | Warehouse Transfer | Weekly |

| 11 | Journal Day Book | Weekly |

| 12 | All Product related Reports -Product Ageing -Stock Valuation -Age of Expired Product | Weekly |

| 13 | Accounts Payable | Weekly |

| 14 | Accounts Receivable | Weekly |

| 15 | Trial Balance | Weekly |

| 16 | Balance Sheet | Weekly |

| 17 | Profit & Loss statement | Weekly |

Step 9: Go Live

Once the above reports are confirmed working & the ERP Users have signed off, the legacy system can be closed and the users can move completely into the new ERP System.

How to do Match back of Reports

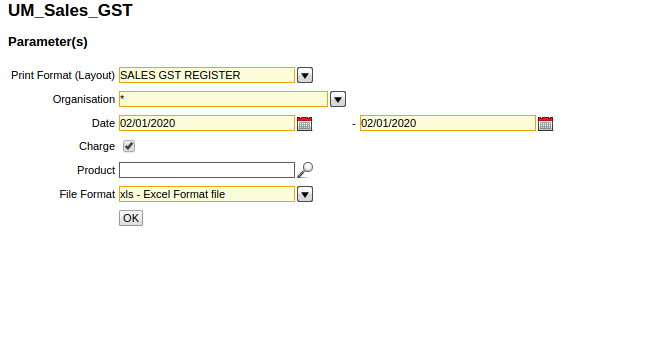

Sales GST

Match back process

- a. The organisation can be filtered Org wise or at * Level.

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- c. If Charge is selected, then only charge related Sales Items (for ex: AMC, CMC charges will be displayed).

- d. If Charge is not selected, then only product-related Sales Items (for ex: Reagents, Consumables, Finished Goods will be displayed).

- e. Every month both product, as well as Charge, needs to be downloaded in Xls format.

- f. In Sales GST Report, we need to match the Sales Total (Line Amount) in Sales GST Report with the Sales Ledger (40001 Ledger Code to 40103) in Trial Balance Credit (less Debit values).

- g. In Sales GST Report, we also need to match the GST Amount across 5%,12%,18%,28% for CHE, HYD, KOL, BANGLORE in Sales GST Report with the Ledger code net of Credit (less Debit values in (24301 Ledger Code to 24382) Trial Balance.

- h. **Note: All credit notes will be included in this report.

- i. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month.

- j. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format.

- k. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit.

- l. In case of differences, then the a Pivot table needs to be created for both Sales GST Report & Accounting Entries by Date & comparison data should be based on Document No.

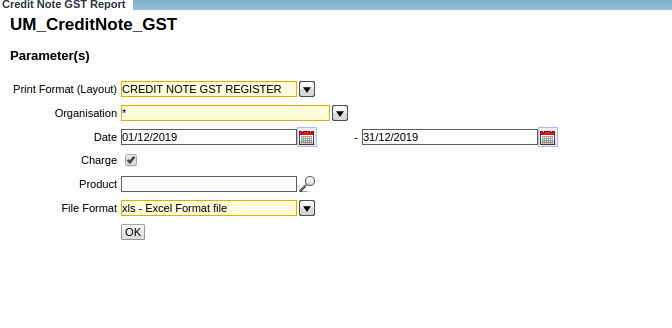

Credit Note GST

Match back process

- a. The organization can be filtered Org wise or at * Level.

- b. From Date & To Date has to be mentioned. (In the case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- c. If Charge is selected, then only charge related Sales Items (for ex: AMC, CMC charges will be displayed)

d. If Charge is not selected, then only product-related Sales Items (for ex: Reagents, Consumables, Finished Goods will be displayed). - e. Every month both product, as well as Charge, needs to be downloaded in Xls format.

- f. In Credit Note GST Report, we need to match the Sales Total (Line Amount) in Credit Note GST Report with the Sales Ledger (40001 Ledger Code to 40103) in Trial Balance Credit (less Debit values).

- g. In Credit Note GST Report, we also need to match the GST Amount across 5%,12%,18%,28% for CHE, HYD, KOL, BANGLORE in Sales GST Report with the Ledger code net of Credit (less Debit values in (24301 Ledger Code to 24382) Trial Balance.

- h. **Note: Only credit notes will be included in this report.

- i. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month.

- j. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format.

- k. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit.

- l. In case of differences, then the a Pivot table needs to be created for both Credit Note GST Report & Accounting Entries by Date & Comparision data should be based on Document No.

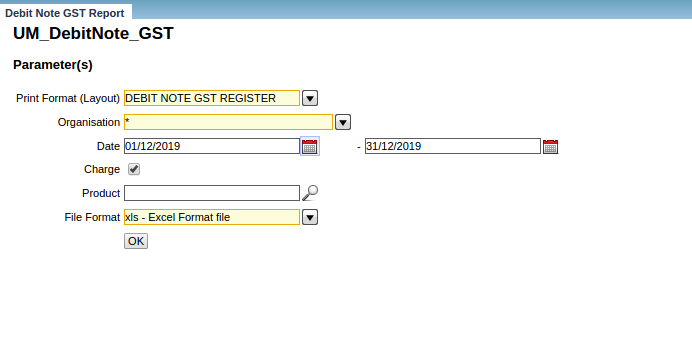

Debit Note GST

Match back process

- a. The organisation can be filtered Org wise or at * Level

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019

c. If Charge is selected, then only charge related Purchase Items with Charge (all expenses excluding Direct Product Purchase like Cab expense, travel expense, rent, EB bill, etc) will be displayed - d. If Charge is not selected, then only product-related Purchase Items (for ex: Reagents, Consumables, Finished Goods will be displayed)

- e. Every month both product, as well as Charge, needs to be downloaded in xls format

- f. In Debit Note GST Report, we need to match the Expenses Total (Line Amount) in Credit Note GST Report with the Trial Balance all product & expenses related GST with Debit Note as Document Type

- g. In Debit Note GST Report, we also need to match the GST Amount across 5%,12%,18%,28% for CHE,HYD, KOL, BANGLORE in GST Report with the Ledger code net of Credit (less Debit values in (19201 Ledger Code to 24383) Trial Balance

- h. **Note: Only debit notes will be included in this report

- i. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month

- j. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format

- k. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit

- l. In case of differences, then the a Pivot table needs to be created for both Credit Note GST Report & Accounting Entries by Date & comparison data should be based on Document No

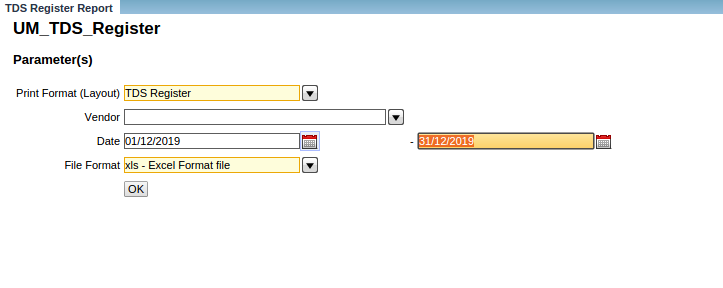

TDS Register

Match Back process

- a. The organisation can be filtered Org wise or at * Level

- b. From Date & To Date has to be mentioned. (In the case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019

- c. The Business Partner wise, document wise, for the period will be populated with the Gross Amount, Charge Name & Tax Deducted Amount with the Tax rate

- d. A Pivot table with the Tax Rate has to be created with the in order to sum up the tax rate wise sum total of the TDS under various sections (194C – 1%, 2%, 194J, 194I, 194H etc)

- e. In the Trial Balance from the Ledger Code 23601 to 23618 are the transactions across various sections the Credit Value less Debit Value (in case of Debit Notes) needs to be matched

- f. **Note: Purchase Invoices, Debit Notes & GL Journal will all be captured

- g. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month

- h. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format

- i. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit document no wise

- j. In case of differences, then the a Pivot table needs to be created for both TDS Report & Accounting Entries by Date & Comparision data should be based on Document No

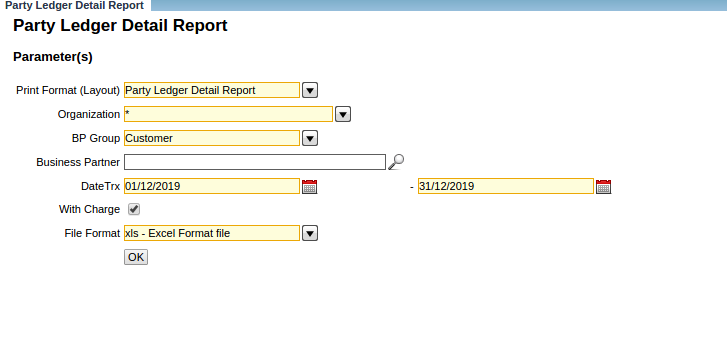

Party Ledger Detailed Report

Match back Process

- a. The organization can be filtered Org wise or at * Level.

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- c. BP Group can be a customer or distributor or supplier.

- d. If charge is selected, then only transactions related to Charge will be displayed. Else all transactions will be displayed across all Business Partner Categories.

- e. This report can be run for individual Business Partners also.

- f. Both Sales Invoices & Credit Notes are included for Customers, Purchase Invoices & Debit Notes for Suppliers etc.

- g. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month.

- h. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format.

- i. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit.

- j. In case of differences, then the a Pivot table needs to be created for both Profitability Report & Accounting Entries by Date & comparison data should be based on Document No.

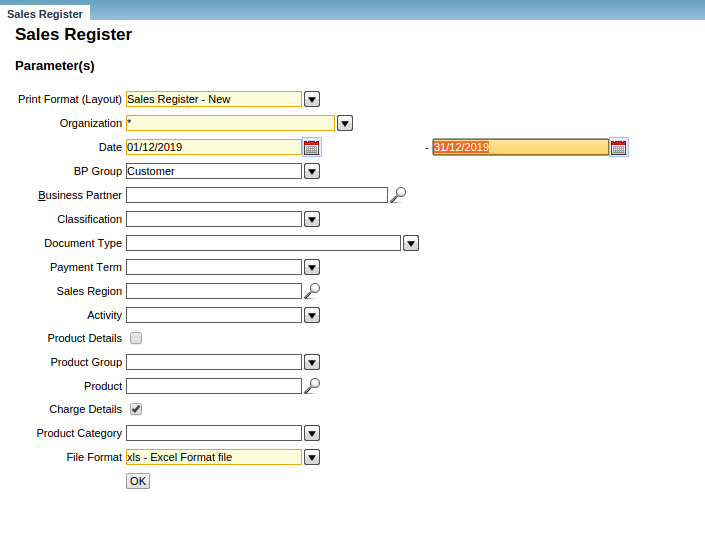

Sales Register

- a. The organisation can be filtered Org wise or at * Level

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019

- c. If Charge is selected, then only charge related Sales Items (for ex: AMC, CMC charges will be displayed)

- d. If Charge is not selected, then only product-related Sales Items (for ex: Reagents, Consumables, Finished Goods will be displayed)

- e. Every month both product, as well as Charge, needs to be downloaded in xls format

- f. In Sales Register Report, we need to match the Sales Total (Line Amount) in Sales GST Report with the Sales Ledger (40001 Ledger Code to 40103) in Trial Balance Credit (less Debit values)

- g. **Note: All credit notes will be included in this report

- h. **Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month

- i. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format

- j. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit

- k. In case of differences, then the a Pivot table needs to be created for both Sales Report & Accounting Entries by Date & Comparision data should be based on Document No

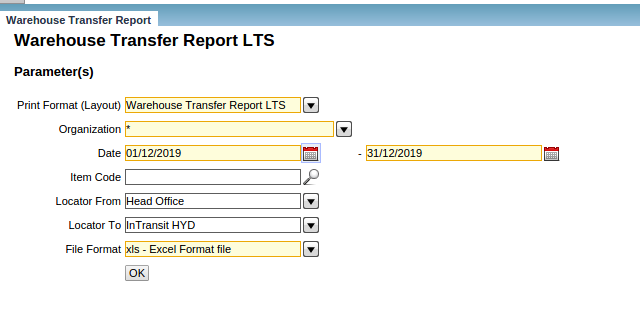

Warehouse Transfer Report

Match back Process

- a. The organisation can be filtered Org wise or at * Level.

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- c. Locator from & To needs to be selected in order to find the from & to the movement of goods.

- d. Every month both product, as well as Charge, needs to be downloaded in Xls format.

- e. The Warehouse Transfer IGST Amount in the Report needs to be matched with 24322 & 24323 24331 & 24332 & 24380 & 24382 Ledger codes under IGST Output for Stock Movement.

- f. The Warehouse Transfer ISGT Amount in the Report also can be matched for 19252, 19253, 24379,24381 & 24383 for Inputs with this report along with 19301 & 19302.

- g. Note: In case documents are created in 1 month & voided in the subsequent month, then also the reports should match in the subsequent month.

- h. For matching with the Trail Balance, the Accounting entries by Date Report need to be downloaded with * Organisation, From & To Date & downloaded in excel format.

- i. In this report, Business Partner wise a Pivot Table needs to be created for each Business Partner through Net of Credit (Less) Debit.

- j. In case of differences, then the a Pivot table needs to be created for both Warehouse Report & Accounting Entries by Date & Comparision data should be based on Document No.

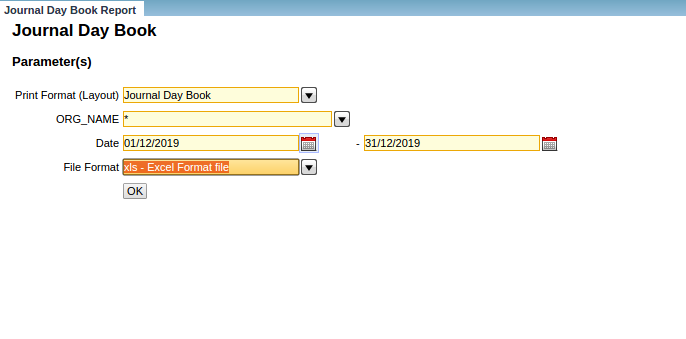

Journal Day Book

- a. The organization can be filtered Org wise or at * Level

- b. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019

- c. All the Journal Entries posted through Journal Process will be updated across various expenses entries with Charge

- d. These values with Document Nos can be matched with the Documents mentioned in GL Journal window

- e. Since all Journals have both Debit & Credit entries the net difference between debit credit total would be zero

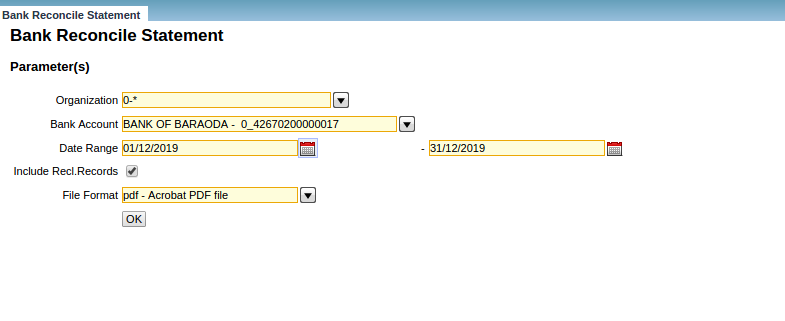

Bank Reconciliation Report

Match Back Process

- a. The organisation can be selected at * level

- b. Bank Account from the list of banks available

- c. From Date & To Date has to be mentioned. (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019

- d. If include reconciliation checkbox is selected all documents which were reconciled will be included

- e. The Bank Statement will be downloaded from the respective Banks

- f. The items which were in debit & credit in the bank statement also need to be identified

- g. Opening Balance + Credit – Debit items will be the closing balance as on any given date

- h. This report can be matched back with the Bank Day Book Report with Document No as filters

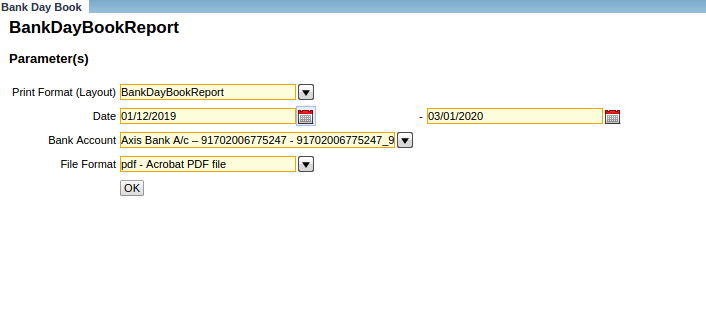

Bank Day Book

Match Back Process

- a. From date & To date has to be mentioned (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- b. The Bank Statement will be downloaded from the respective Banks.

- c. This report is basically to cross verify with the Bank statement & matched back with Document No as filters.

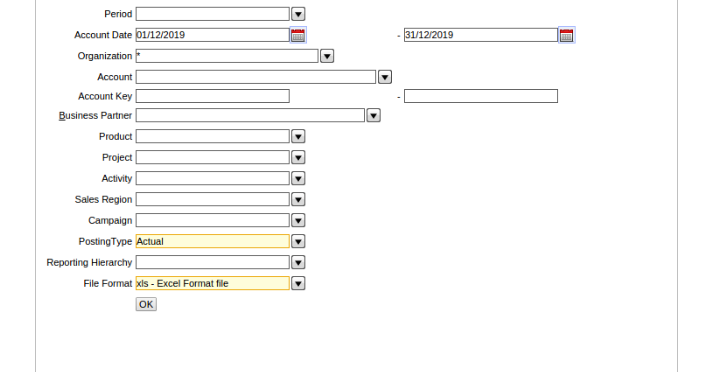

Trial Balance – Debit & Credit Control

Match Back Process

- a. This is a default report.

- b. From date & To date has to be mentioned (In case on a monthly basis, the 1st& the Last Date of the month to be mentioned. Forex: for Apr 2019, From Date – 01/04/2019 To Date – 30/04/2019.

- c. The organisation can be individual Organisation or * Level.

- d. Account Key – From & to Account Code can be given in order to only filter the account codes required for verification.

- e. Individual Business Partner, Product, Activity, Sales Region are all dropdowns that can be selected for verification records.

- f. Output can be in Xls format.

- g. This is the Base document (accounting entries by date report with account code, From & To Date, the output is Xls is the detailed split for the Trial Balance.

- h. This report forms the basis for comparison with all reports including Receivable, Payable, Purchase, Sales, Stock, etc.

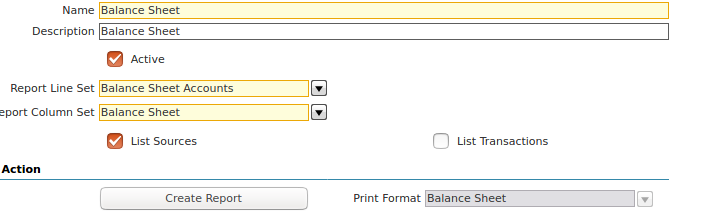

Balance Sheet

- a. The Organization has to be always at the * Level

- b. This Report always needs to be verified at a YTD Level (from the 1st date of the Financial Year)

- c. The output has to be in Xls

- d. All the Balance Sheet related Assets, Liabilities, Equity etc will appear in this report

- e. **Note: The Difference between Revenue & Expense will alone need to be appearing in this report

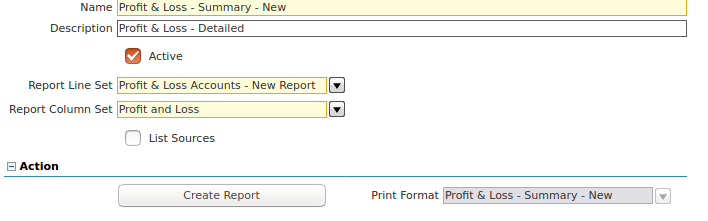

Profit & Loss Statement

- a. The Organization has to be always at the * Level.

- b. This Report always needs to be verified at a monthly Level (from the 1st date of the Financial Year).

- c. The output has to be in Xls.

- d. All the Income (Direct & Indirect) & Expenses (COGS, Employee Cost, SG& A costs).

- e. **Note: The Difference between Revenue & Expense will be carried forward to the Balance Sheet Report.