How to Use the Compiere ERP Application

Master Data Configuration

1.1 Warehouse & Locators

1.2 Unit of Measure

1.3 Product Category

1.4 Product

1.5 Price List Setup

1.6 Discount Schema

1.7 Charge

1.8 Business Partner Group

1.9 Business Partner

2.0 Calendar Period

2.1 Account Element

2.2 Account Combination/Organisation

2.3 Currency Rate

2.4 Document Type

2.5 Document Sequence

2.6 Tax Category

2.7 Payment Term

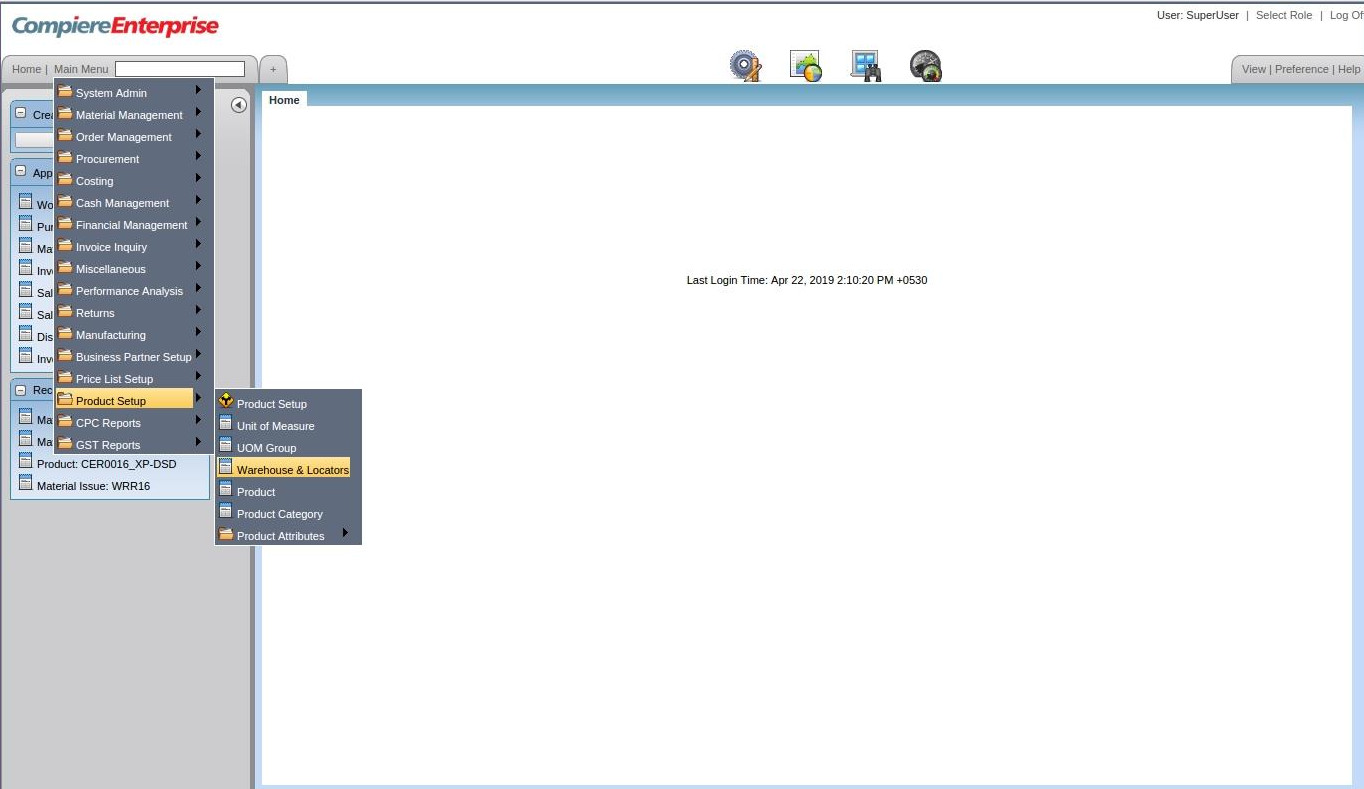

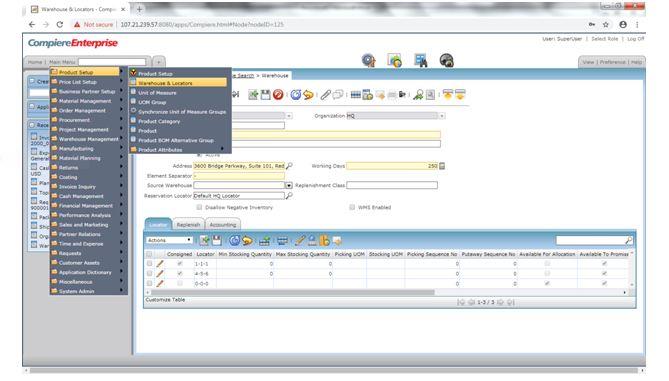

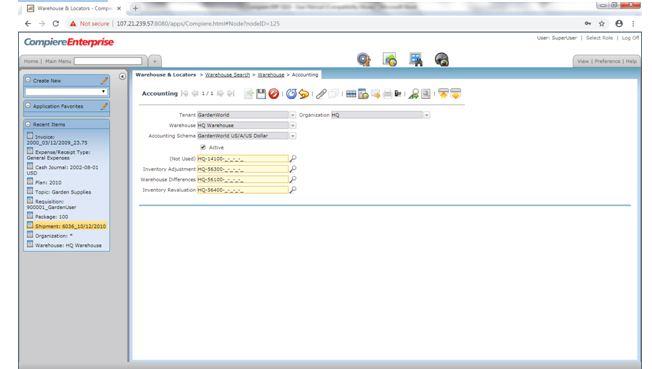

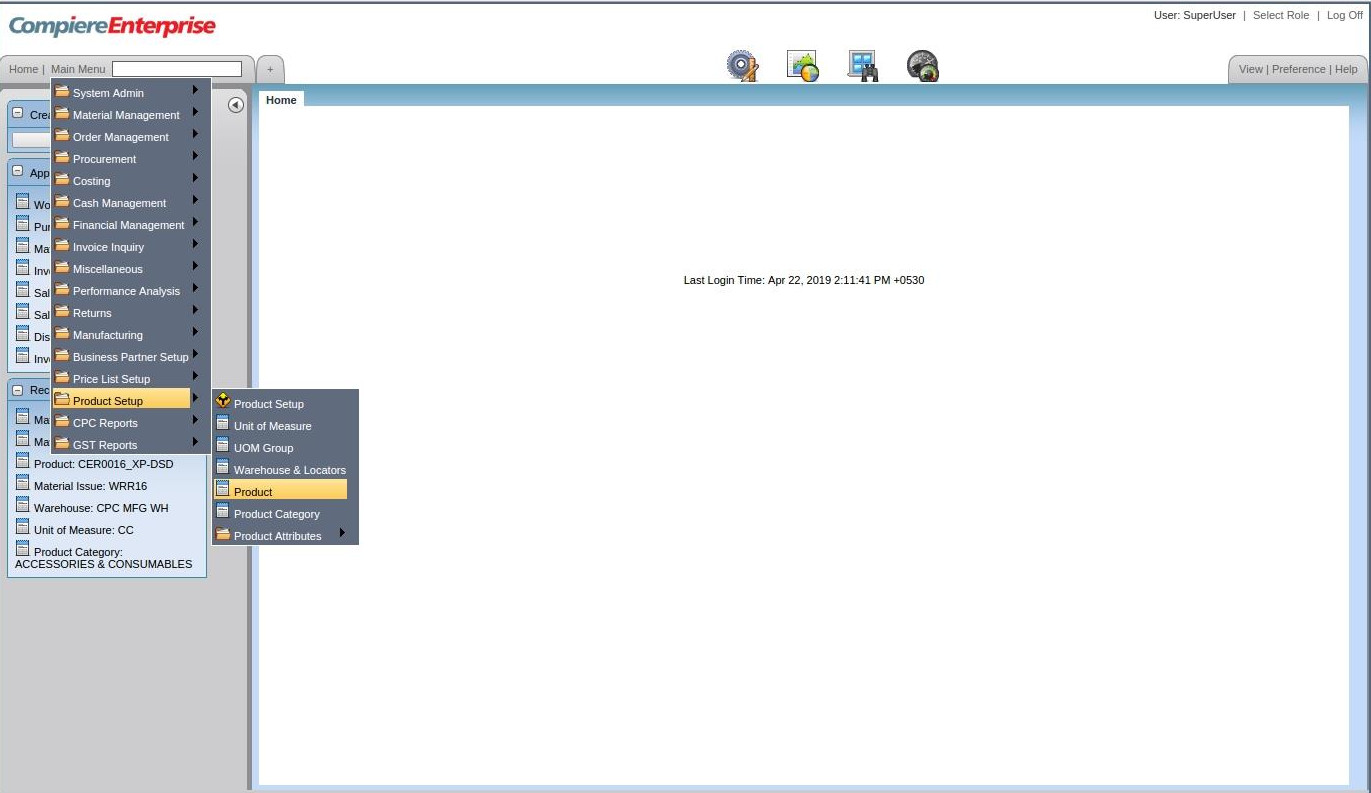

1.1 Warehouse & Locators

Main Menu –> Product Setup –> Warehouse & Locators

The primary purpose of a Warehouse Management is to control the movement and storage of materials in a warehouse.

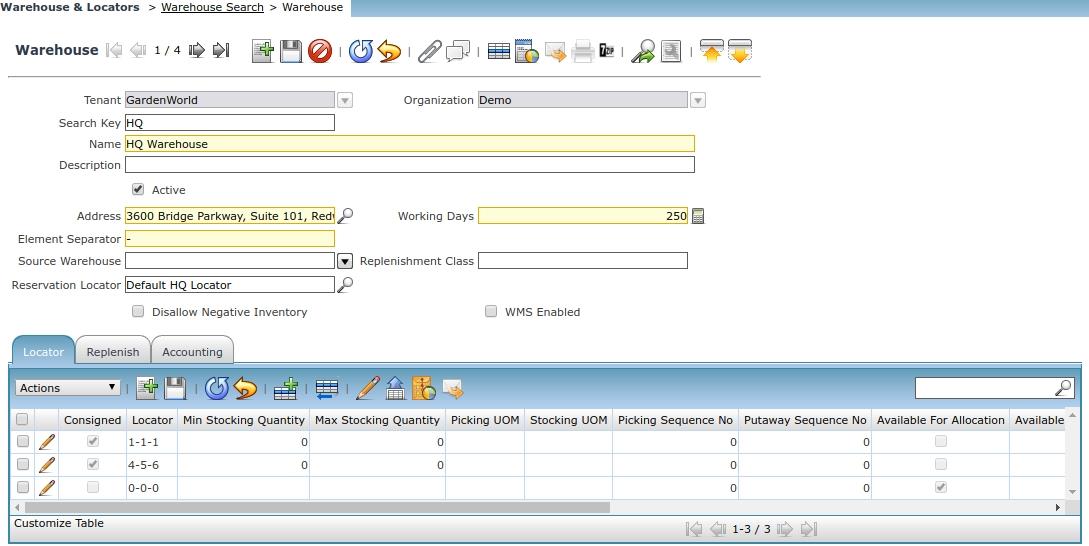

Search Key: Any unique ID for the user to identify the warehouse easily

Name: Name of the Warehouse where the goods are to be stored

Address: Address of the above warehouse

Working Days: No of working days of the warehouse in the year

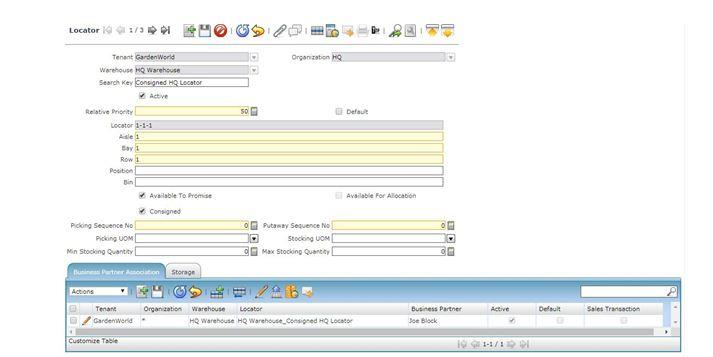

Picking UOM and Stocking UOM: There is a field Available to Picking and the Stocking UOM. The picking UOM should be less than or equal to the stocking UOM. eg if the Picking UOM is 6 then the stocking UOM should be 7 or more than 7.

The Minimum and the Maximum Stock Quantity: Minimum and Maximum stock quantity are stock limits for the customer location product that the customer agrees upon with the supplier. The projected Stock quantity must not fall below the minimum stock Quantity. The maximum stock level is the maximum quantity of stock that is to be on hand at the customer.

Available to Promise: Is the projected amount of inventory you have left available to sell, it does not include allocated inventory. The quantity of the product in the locator will be considered as on-hand, and available for reservation to sales orders and other demands.

Available to Allocation: If this flag is checked, the quantity of the product in the locator will be considered as on-hand, and will be available for allocation to sales orders and other demands.

Click Add button to create new locators

Locator Search Key: The search key for the Locator associated with the warehouse

The Product can be selected from the dropdown & the minimum & maximum quantity can be added to this window

Replenish

This feature defines the minimum and maximum level of stocks to be maintained in the warehouse. Triggered replenishment can help ensure that a picker always has enough inventory in the most efficient picking location. Select the replenishment type from the dropdown.

Click Add button to create new Replenish items

Accounting

The accounting ledger for the warehouse needs to be defined for the tenant CPC Diagnostics

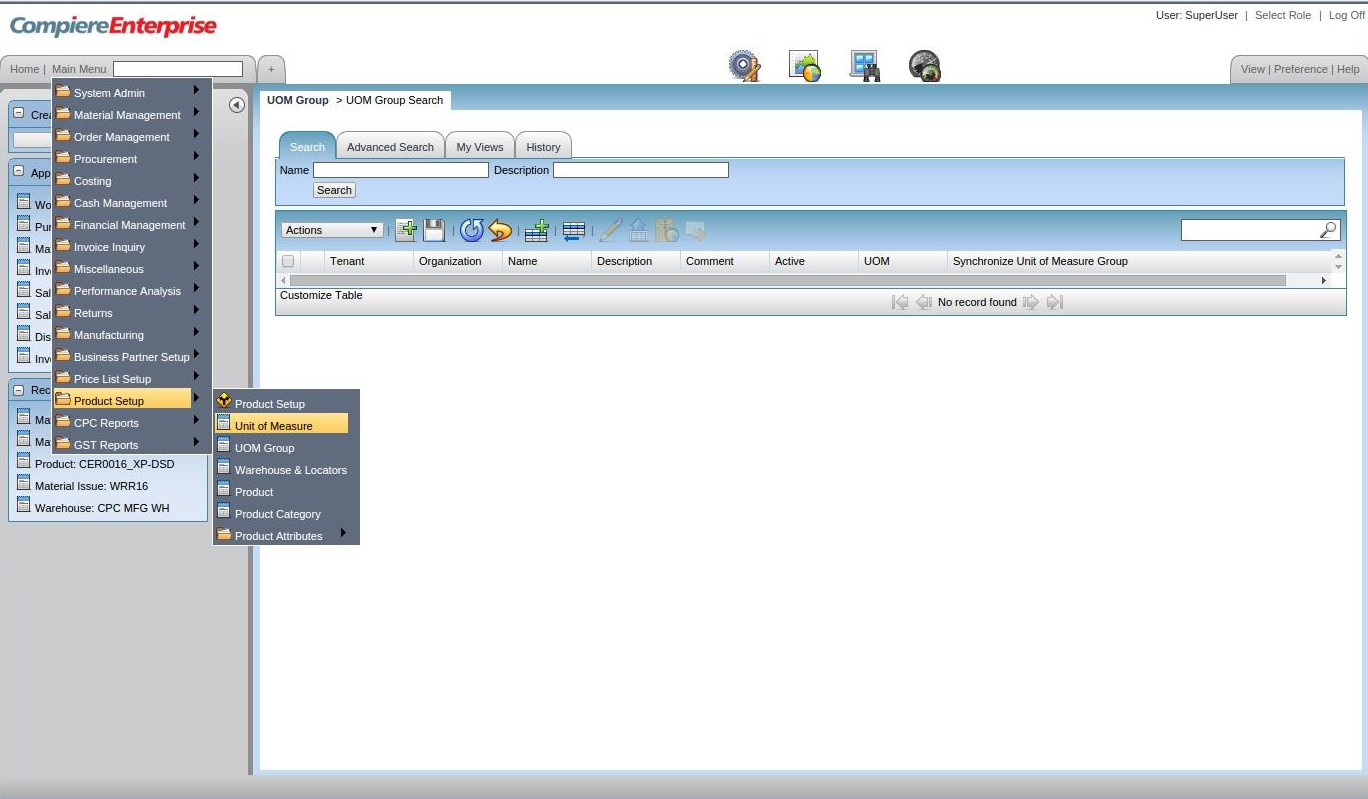

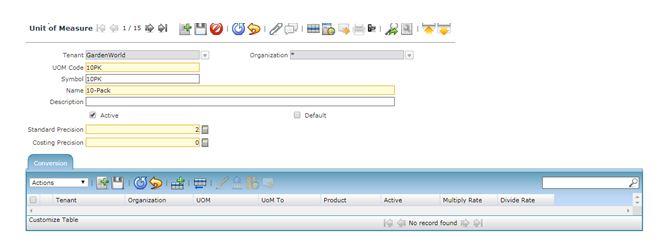

1.2 Unit of Measure

Main Menu –> Product Setup –> Unit of Measure

Typically an Item/Product can be sold in different types of packaging than how it is purchased from the vendors. The unit of measurement is used in Invoice, Item and purchase order documents.

| Kgs | Litres |

| Cubic Centimetre | Metric Tonne |

| Weeks | Working Days |

| Number | Minute |

Click Add button to create the Unit of Measurement for tenant CPC Diagnostics

UOM Code: Abbreviations for the pack name

Name: name of the pack

Standard Precision: The no of decimals required for accounting

Costing Precision: The no of decimals required for costing

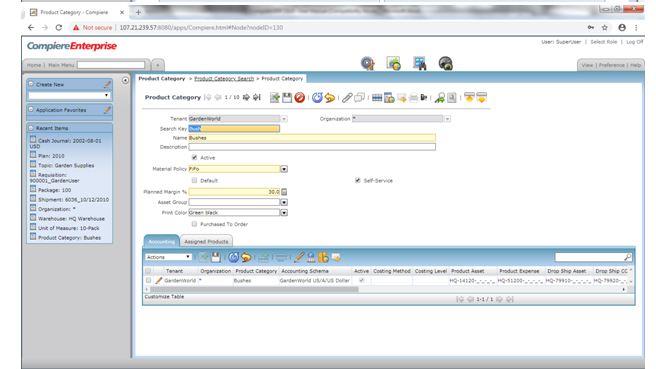

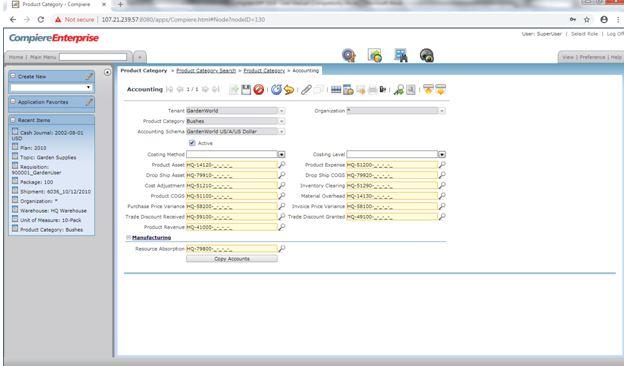

1.3 Product Category

Main Menu –> Product Setup –> Product Category

Product Category: When a product category is created and all products are associated with the product category.

Click Add button to create a new Product Category for

Name: Name of the Product Category. Product Categories are created to organize the products in eg Reagents, Consumables & Accessories

Material Policy: FIFO (First In First Out)/LIFO (Last In First Out). The material policy can be configured at the product category level, which is used during shipment generation to pick the products. The material policy is based on the movement date.

Planned Margin: % of Margin expected: User has to enter manually 0

The Accounting element for the Product Category needs to be defined.

- Ex: Product Asset à All stocks/assets with Balance Sheet impact

- Ex: Product Expense: All expenses with Profit & Loss impact

- Ex: Product COGS: All stocks with Purchases in trading impact

Copy accounts process will help in copying the respective accounting to all Products under this category

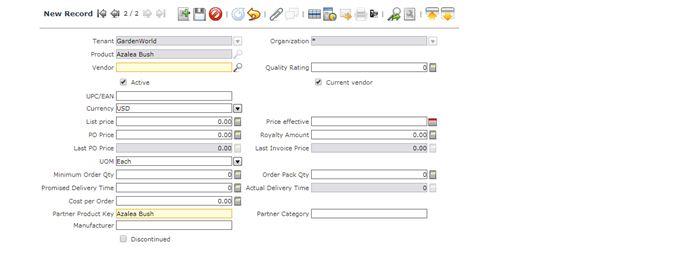

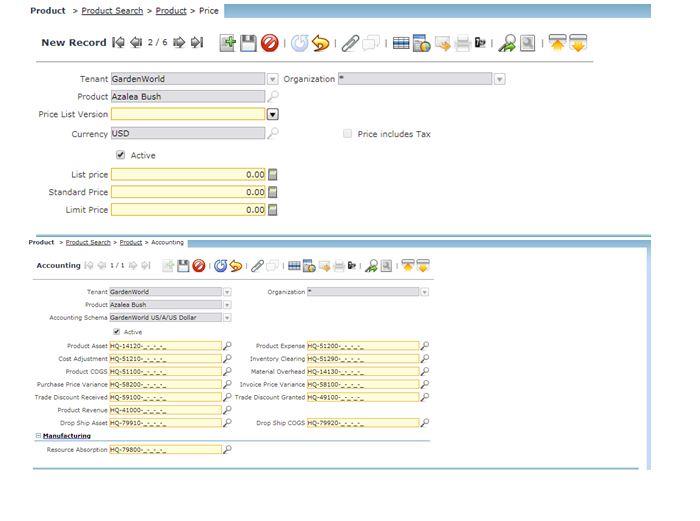

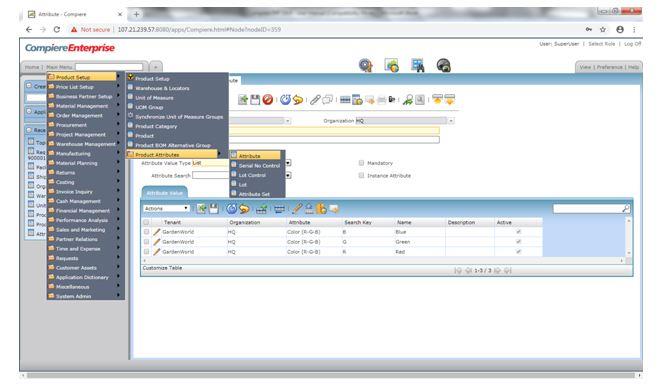

1.4 Product

Main Menu –> Product Setup –> Product

A product can be a service or an item. Every product is produced at a cost and is sold at a price. The price that can be charged depends on the market, the quality, the marketing and the segment that is targeted.

Define the Name of the Product, Product Category, Tax category, Unit of Measure and Product Type.

Check Bill of Materials in case the product is a finished good and verify BOM to define and confirm the raw materials

Check Manufactured –> if the product is manufactured

Copy BOM: Copy Bill of Material and Verify the Bill of the Material in the product Screen is available.

The BOM Use has to be changed to Manufacturing for all BOM assembling related products

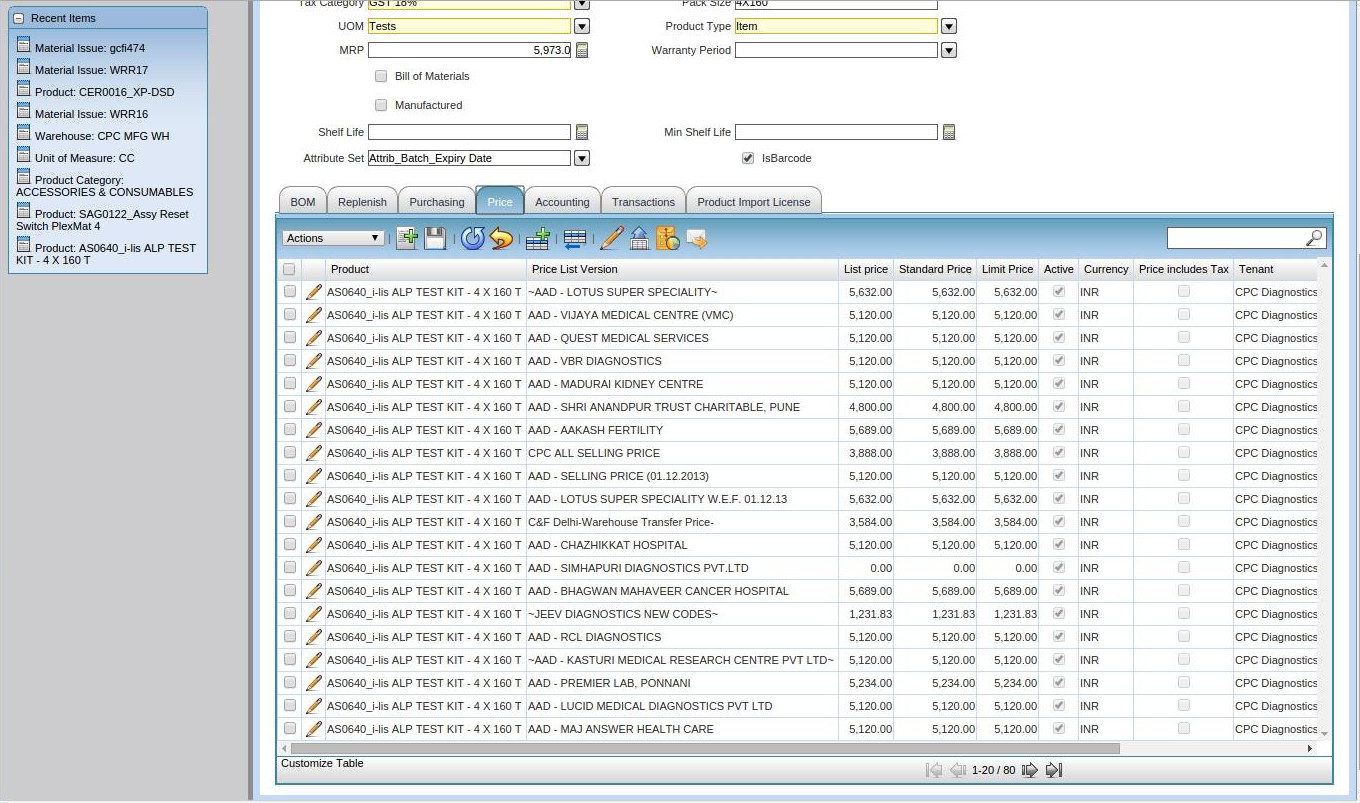

Any number of price list can be created for these products under the Price Sub Tab

For each Product, a Product category has been mapped. The accounting ledgers will get automatically populated from the same

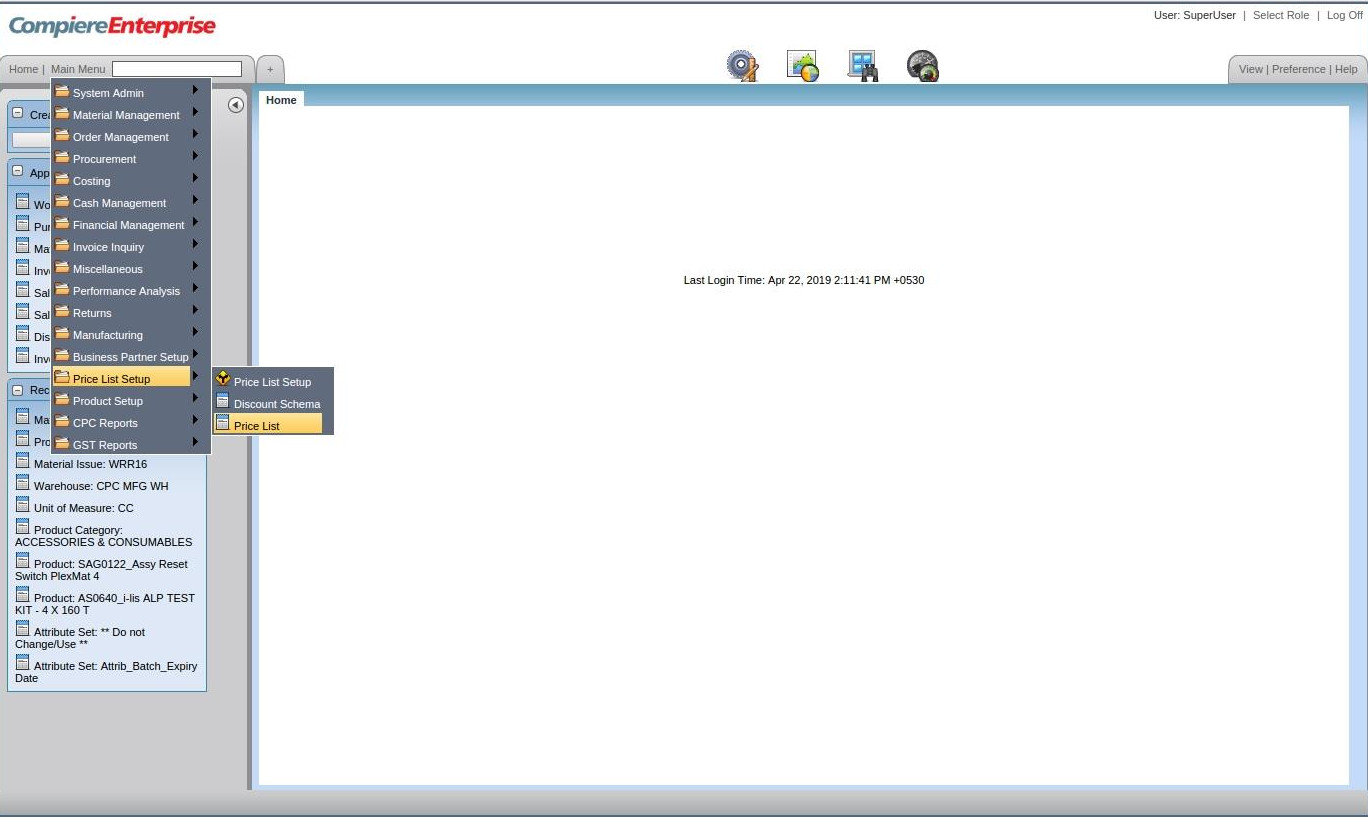

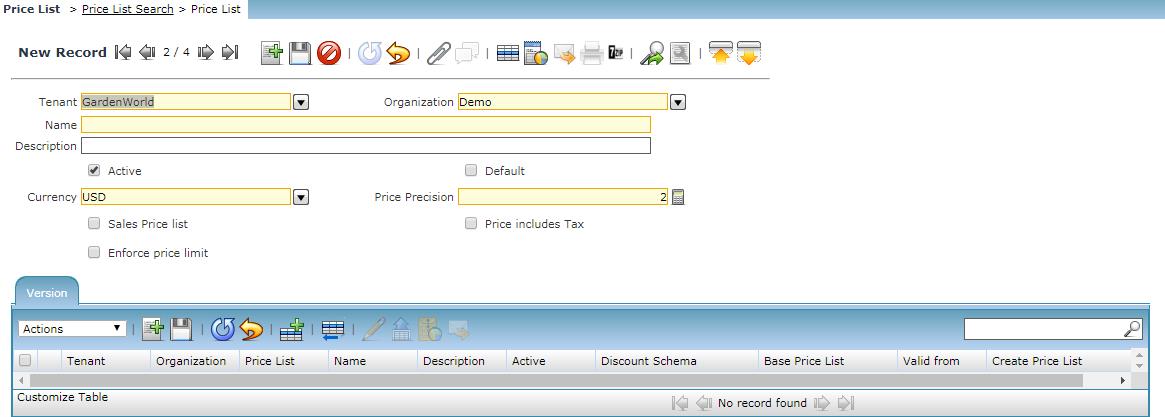

1.5 Price List Setup

Main Menu –> Price List Setup–>Price List Setup

A price list is a list of the prices of goods or services. The pricing for vendors, agents and Customers is defined using price list Menu. The generic Price List is the sales price list and the purchase Price list.

Click on New Record to create a New Price List

each Price List can have multiple Price List version

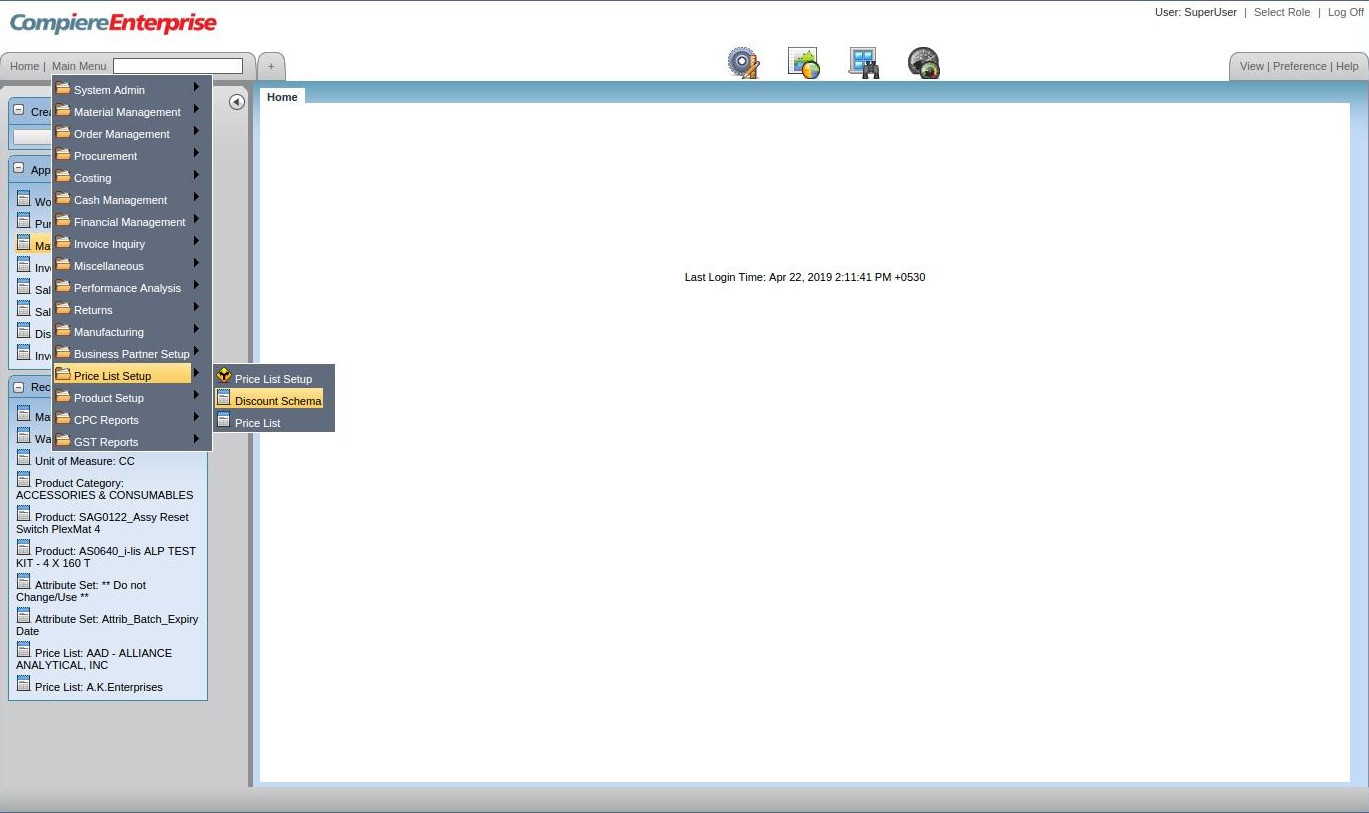

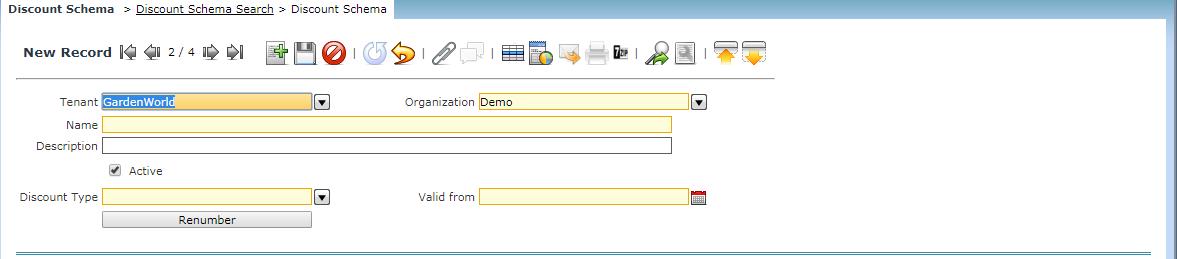

1.6 Discount Schema

Main Menu –> Price List Setup–>Discount Schema

The discount schema allows you to define the discount schema on which the price list is defined by this menu determines how to calculate the prices using the base as the vendor price or any other price listed as the main source.

Click on Discount Schema Search Button to search the list

Click On Add New Button to add the New Discount Schema. Select the Tenant, Organization, Define the Name, the Discount Type and the discount Valid from date. Add descriptions if required.

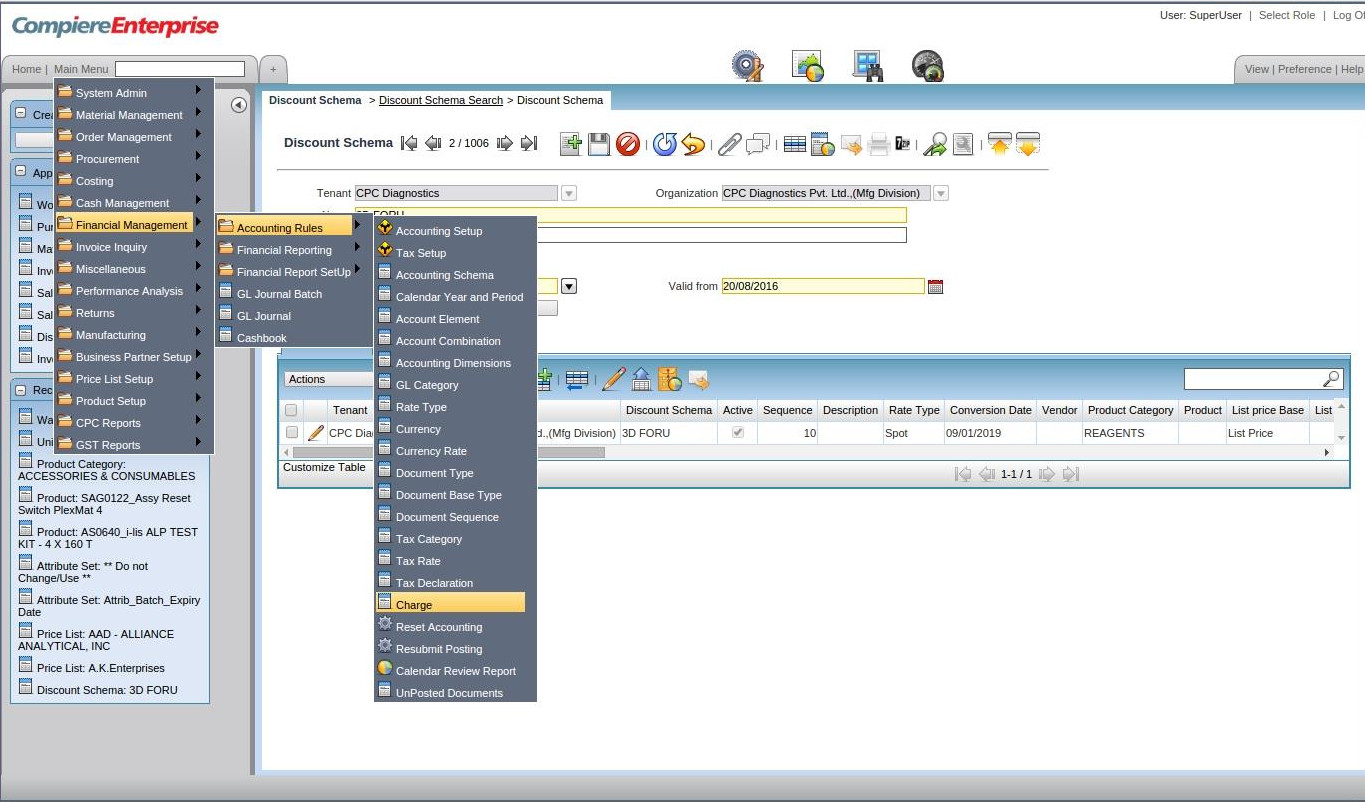

1.7 Charge

Main Menu –> Price List Setup–>Discount Schema

For transactions other than a Purchase or Sale of products, can uses Charge to make Purchase, Sales, Payment In & Payment Out? For ex: Payment of TDS

The Charge amount by default has to be 0

The Tax Category has to be default GST-TDS-RCM

In the Accounting tab, the Charge Expense & Charge Revenue has to be mapped to the same ledger code

For ex: TDS 94J payment – both Expense & Revenue to mapped to same ledger account code

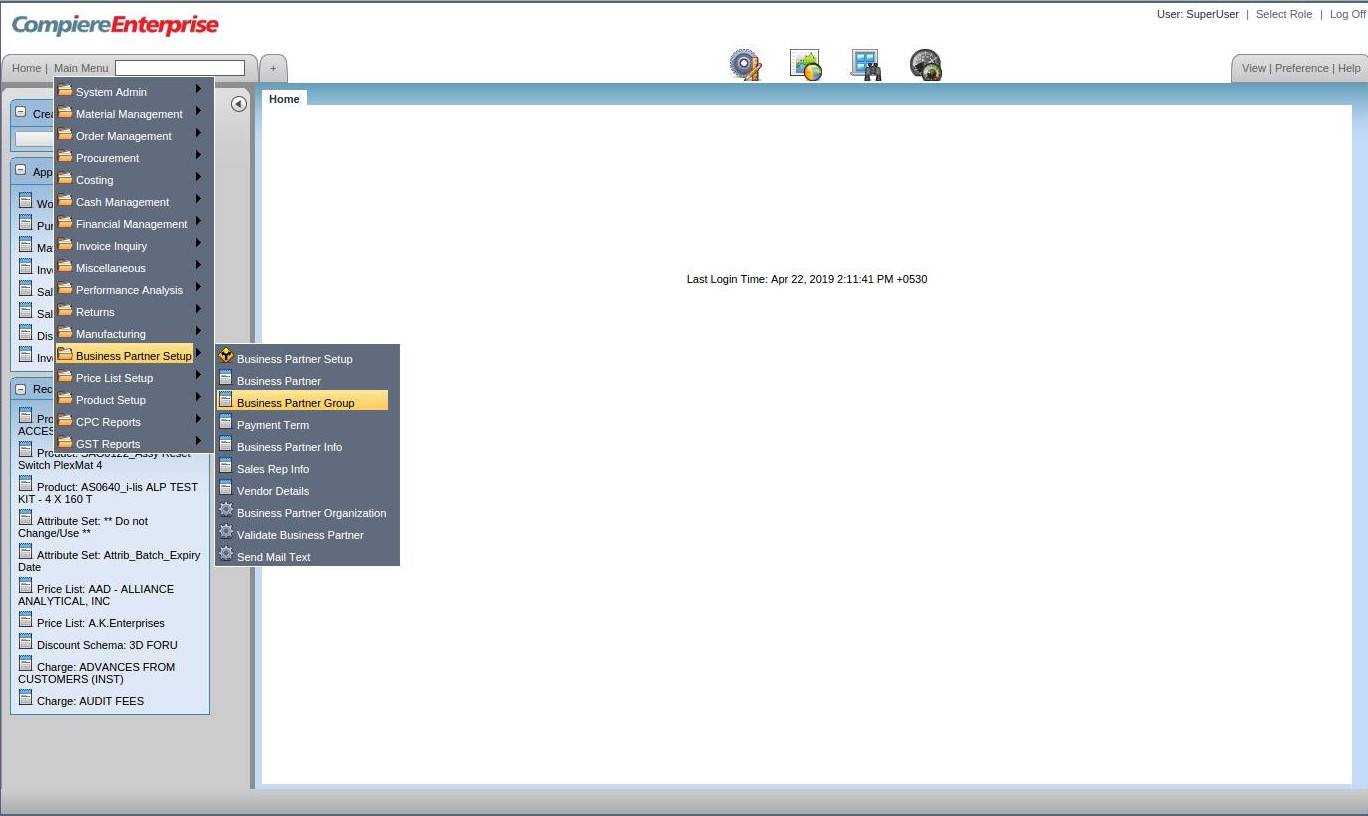

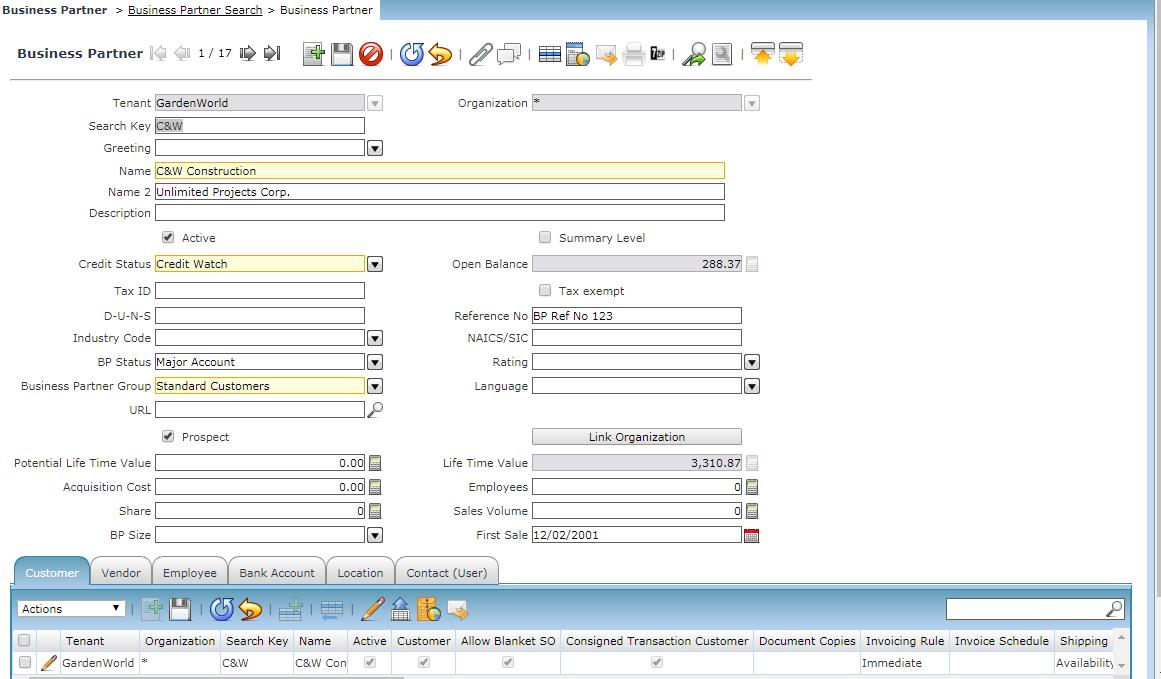

1.8 Business Partner Group

Main Menu–>Business Partner Setup–>Business Partner Group

Click on Add New Button to add the new Business Partner Group. Enter the Name and the description of the group. We can also check the group to be active or the default group.

Select a Print Colour specifies the color used when displaying the business partners.

In the Accounting tab, the customer receivables, prepayment, vendor payables, vendor prepayment, etc need to be configured to the respective account codes. By giving a copy to accounts the entire Business Partner group related vendors/customers etc the accounting codes will be auto-populated

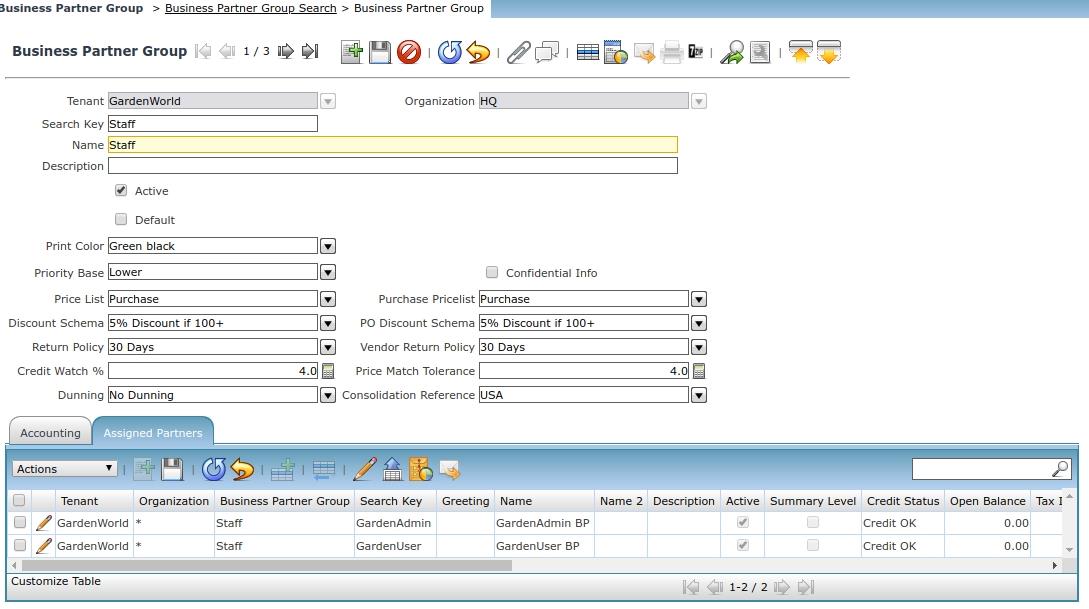

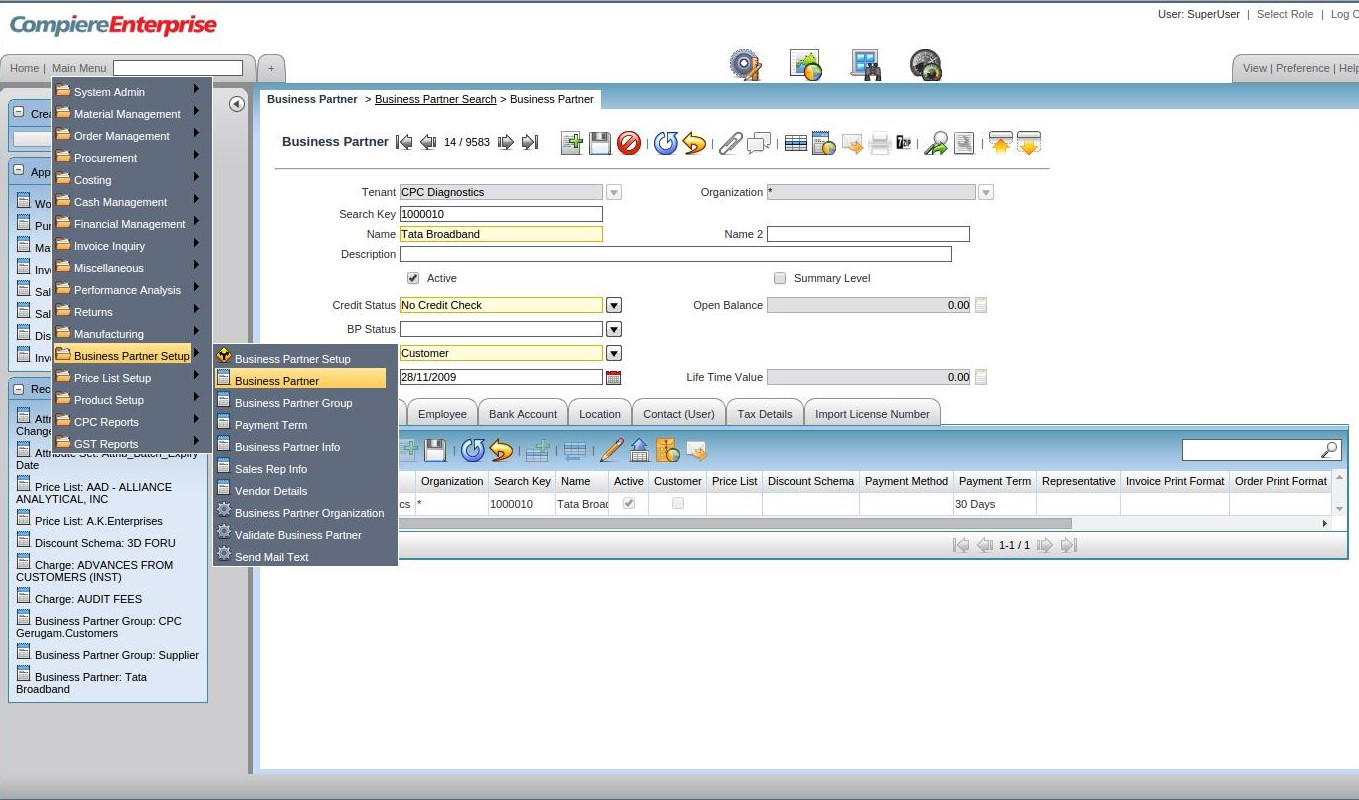

1.9 Business Partner

Main Menu–>Business Partner Setup–> Business Partner

Business Partners defined by the tenant Garden World are vendors, employees, and the end customers. Business Partner is mapped to the Business partner group. This is to differentiate between the vendors, agents and manufacturers in the garden world.

Name to be entered

The Business Partner group to be mapped

Credit Status to be default as No credit check

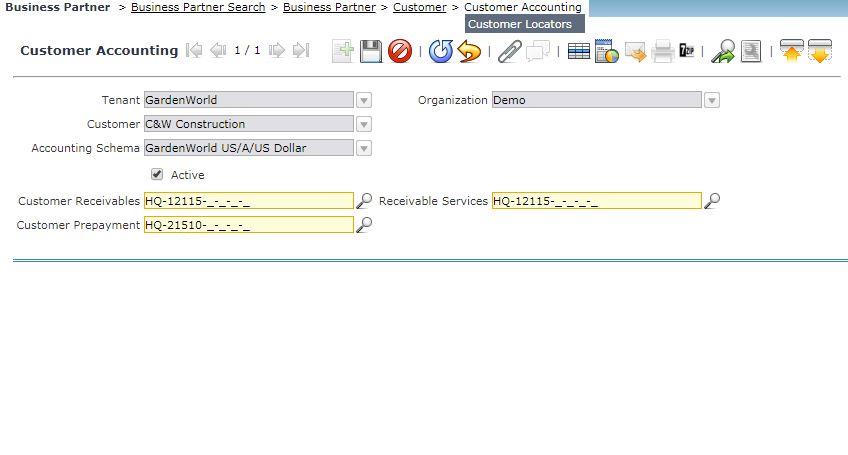

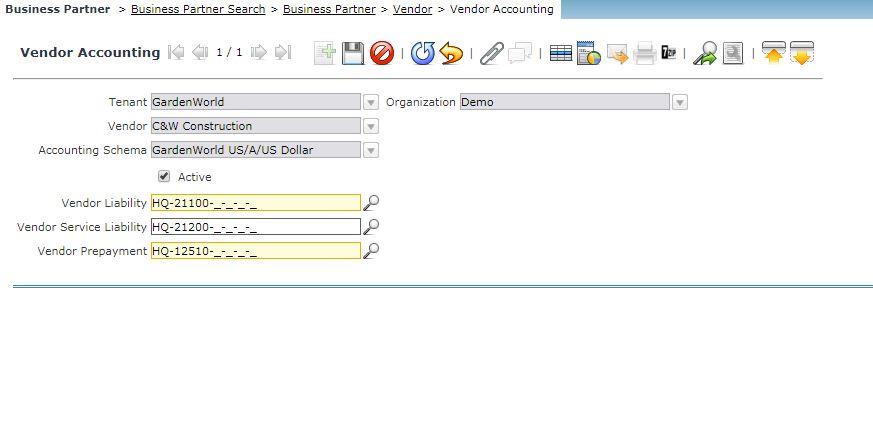

Customer/Vendor/Employee Accounting tab

The accounting codes from the Business Partner Group will be mapped here

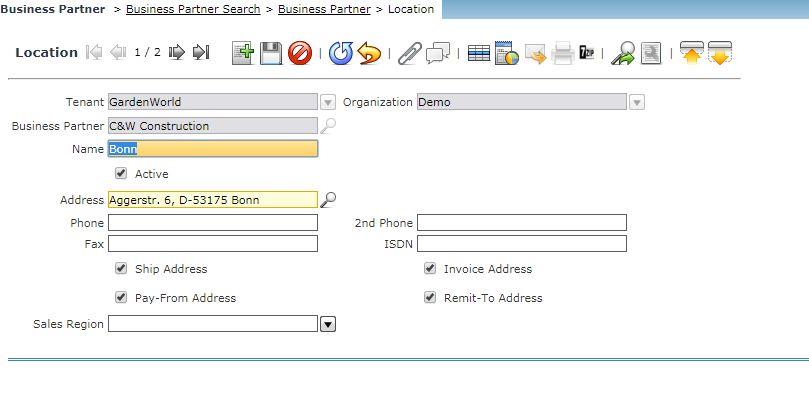

Location Tab

In the name box, the city of the Customer/Vendor to be mentioned

In the Address box, the entire postal address needs to be mentioned

The Shipping Address, Invoice Address boxes need to be checked if all addresses are the same

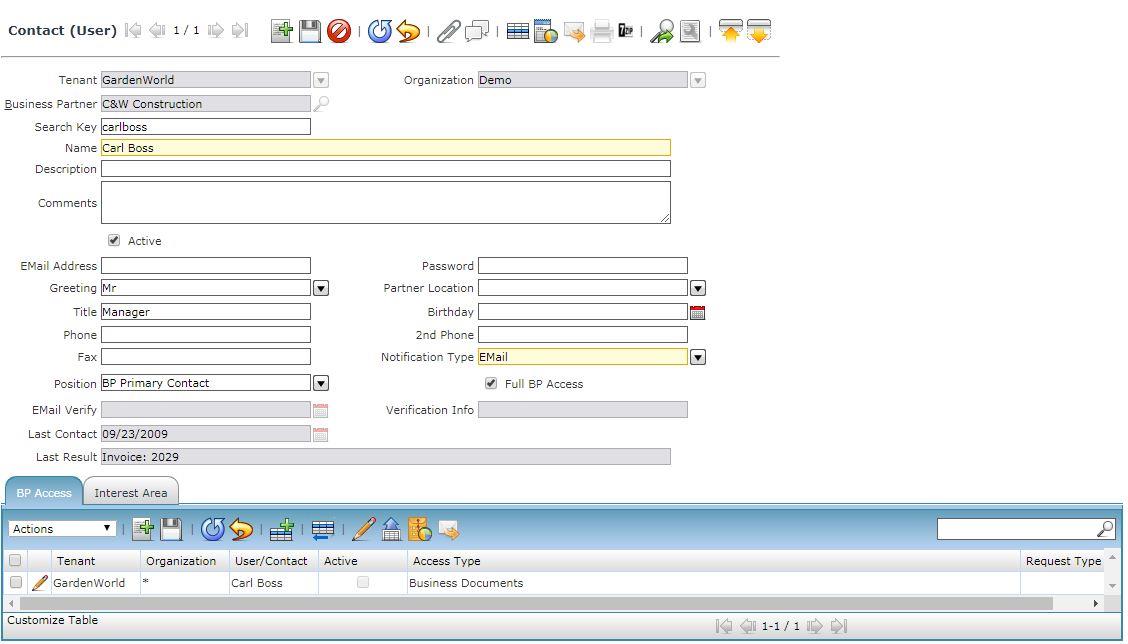

Contact user

The contact person, his email ID for sending emails and other features needs to be defined in this sub-tab

In the Business Partner tax details the Tax category to be selected and then the Tax No to be given

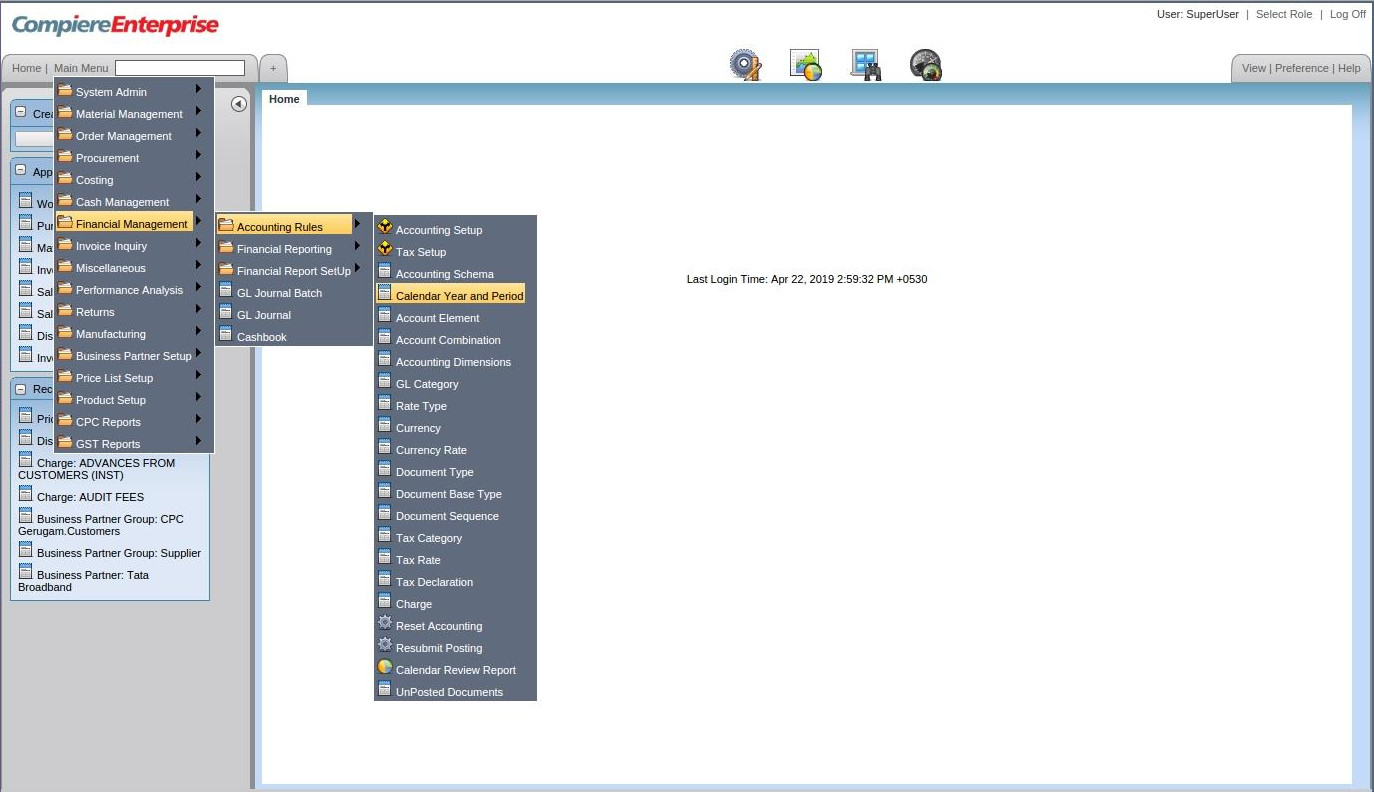

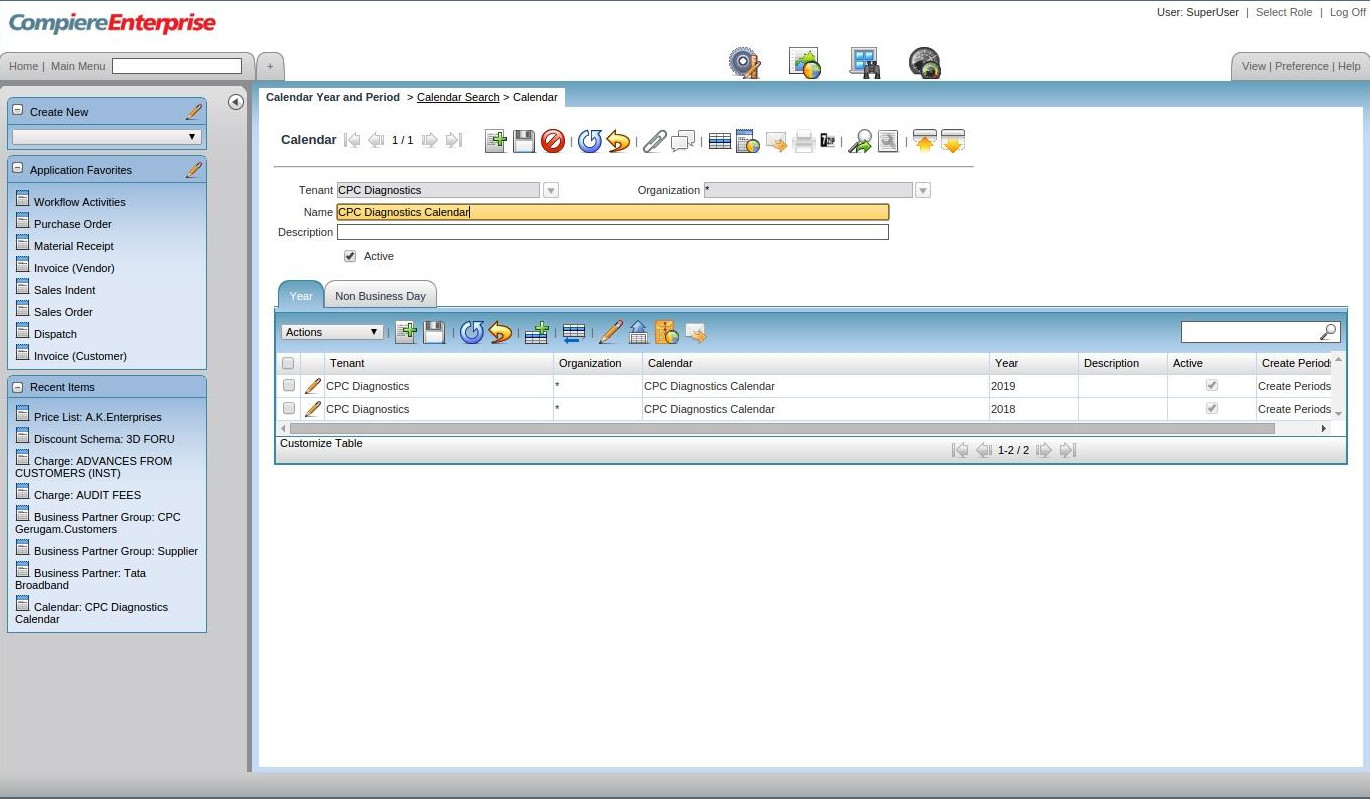

2.0 Calendar Period

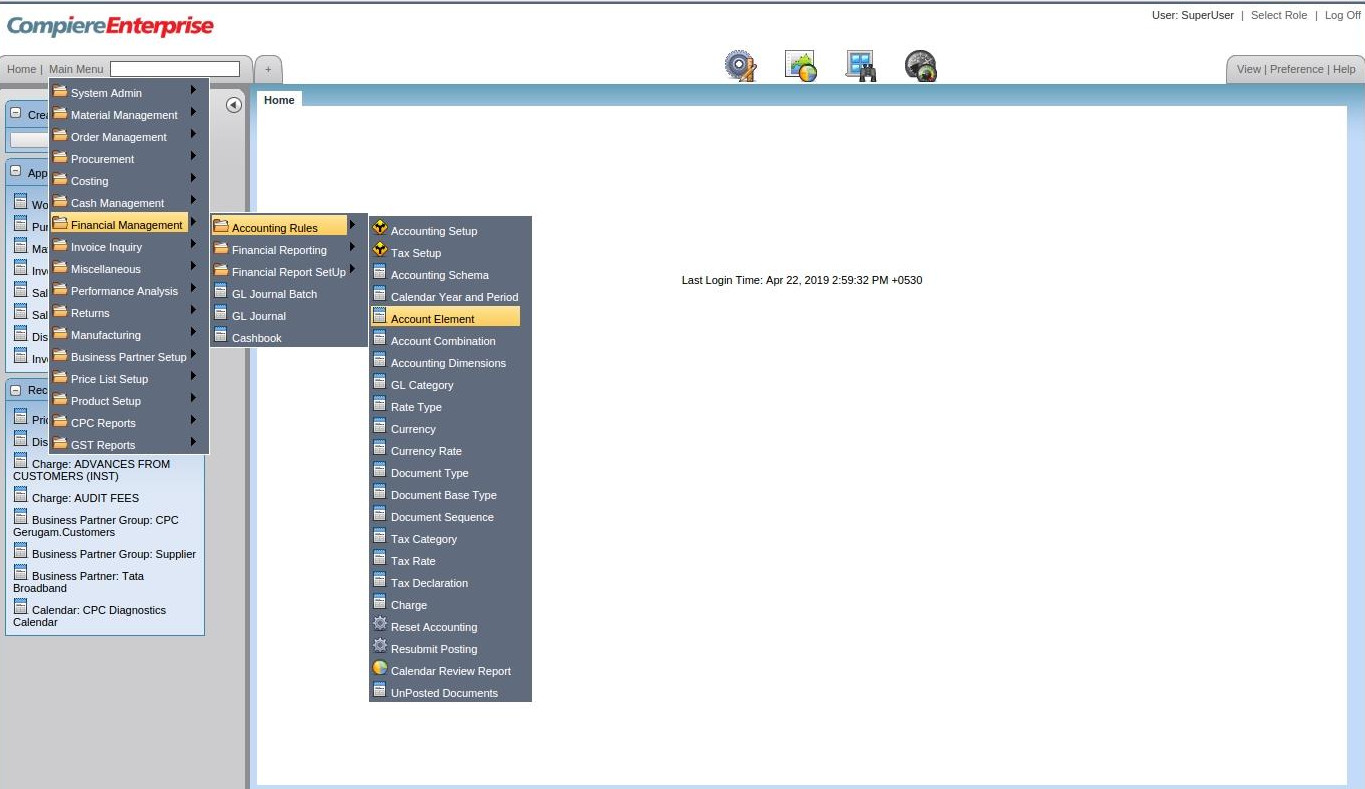

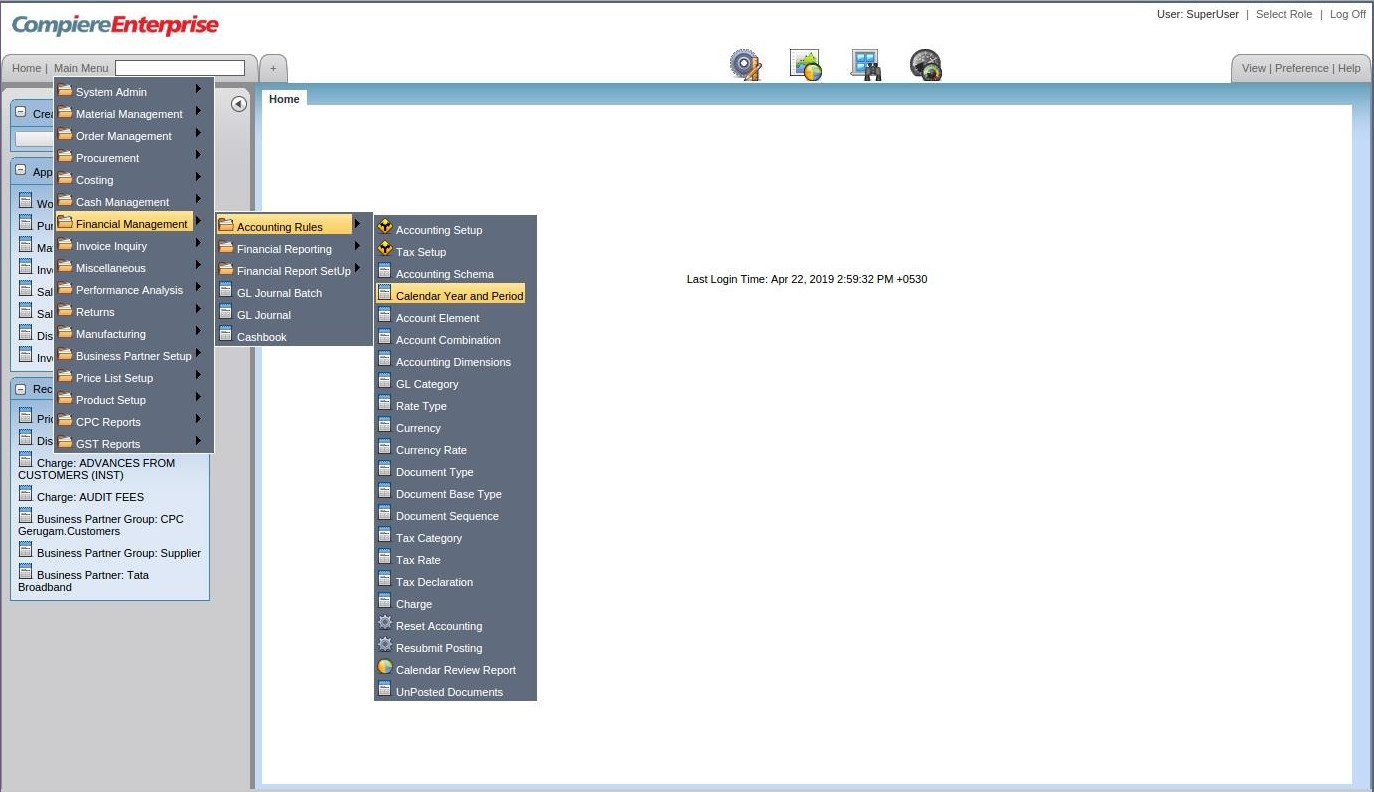

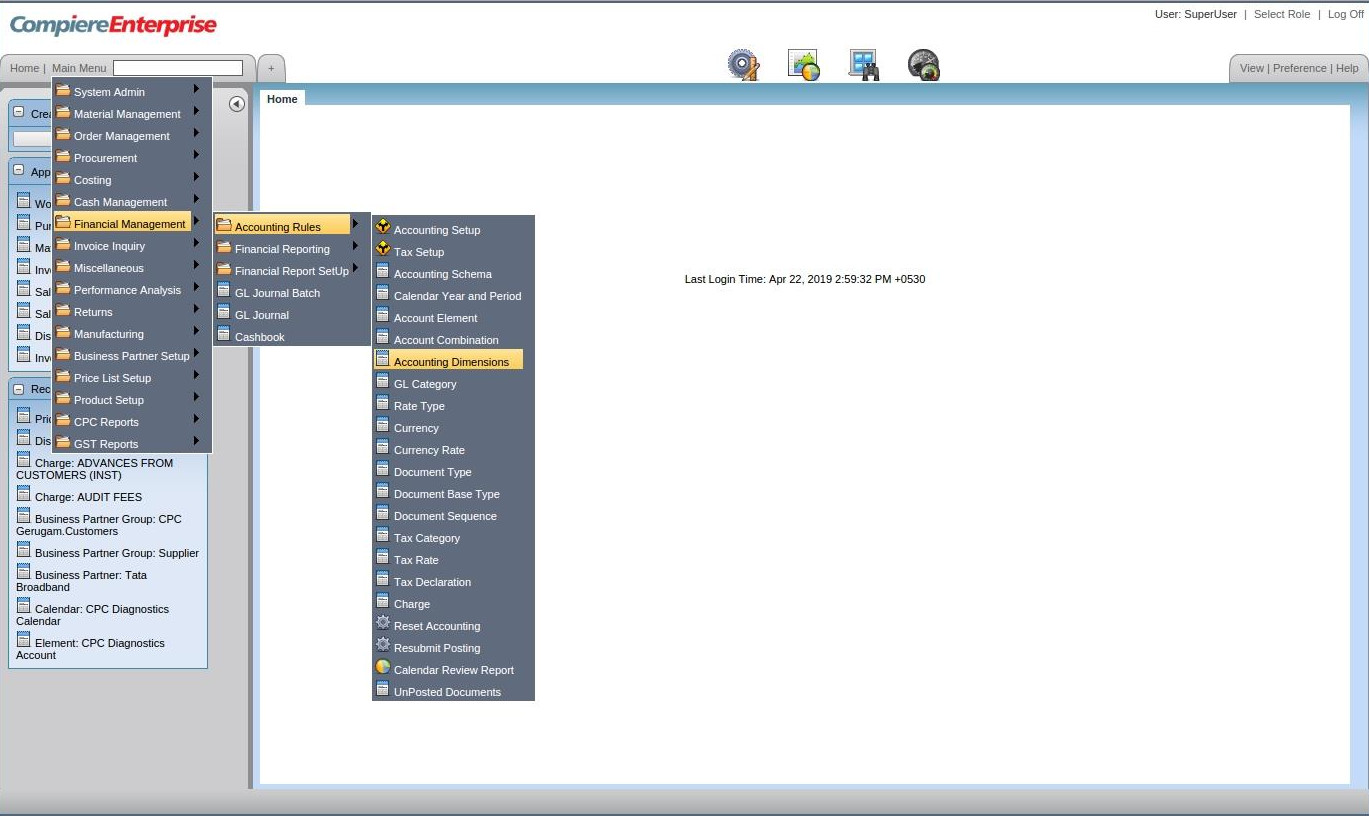

Main Menu–>Financial Management — > Accounting Rules — > Calendar Year & Period

The Calendar Year and Periods define the calendars that will be used for period control and reporting. You can also define non-standard calendars (e.g. business year from April to March)

To Click on Create a new Calendar Period we need to define with a Name for the Organisation & Tenant

Forex: For CPC we can define for Name & Description

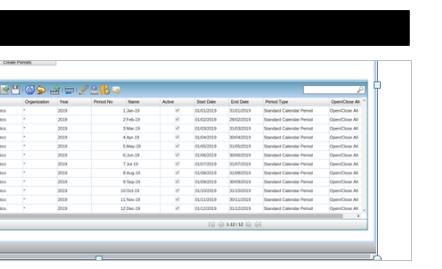

Under each Period, we need to define the Period No & Name & Start & End Date will have to be entered

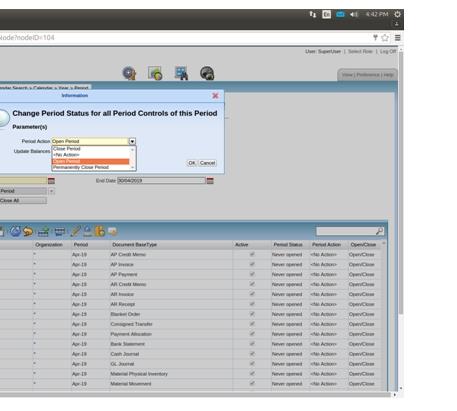

And each document can also be opened or closed for control purpose

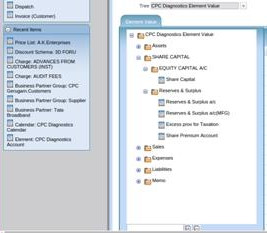

2.1 Account Element

Main Menu–>Financial Management — > Accounting Rules — > Accounting Element

The Account Element Window is used to define and maintain the Accounting Element also popularly called as Chart of Accounts of Any Organization

For any Organization the 5 Key headings under the Chart of Accounts is (Owner’s Equity, Liabilities, Assets, and Revenue & Expenses)

Assets can be classified as Fixed, Current, etc

Share Capital is Owners Equity & Reserves & Surplus

Sales include Product Sales & Services Sales etc

Expenses include Product COGS, Employee Cost, and Finance Cost, etc

Liabilities include Short Term, Long Term Liabilities

Note: The Element needs to be created at the * Organization

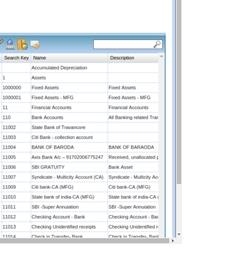

Search Key: Short Cut key for

Name: As IS to appear in Trial Balance

Account Type to be defined as Asset, Liability, Expense, and Revenue

Account Sign has to be the only Natural

If the Summary level checkbox is clicked, then it is an Account

All elements mapped under it are called Sub Accounts

**All Sub Accounts with correct search key to be correctly mapped to the respective Group Accounts

Search Key: The Header/Breakdown/Account/Sub Account Code defined for each element value created

Summary Level: For Header, Breakdown, Accounts alone, the Summary Level checkbox needs to be clicked in order to total the values under Each

Post Actual: Checkbox needs to be selected for Sub Accounts, Budgets can also be defined

2.2 Account Combination/Organisation

Main Menu–>Financial Management — > Accounting Rules — > Accounting Combination

Accounting Dimensions refers to the number of Companies which can be created under Organizational Structure

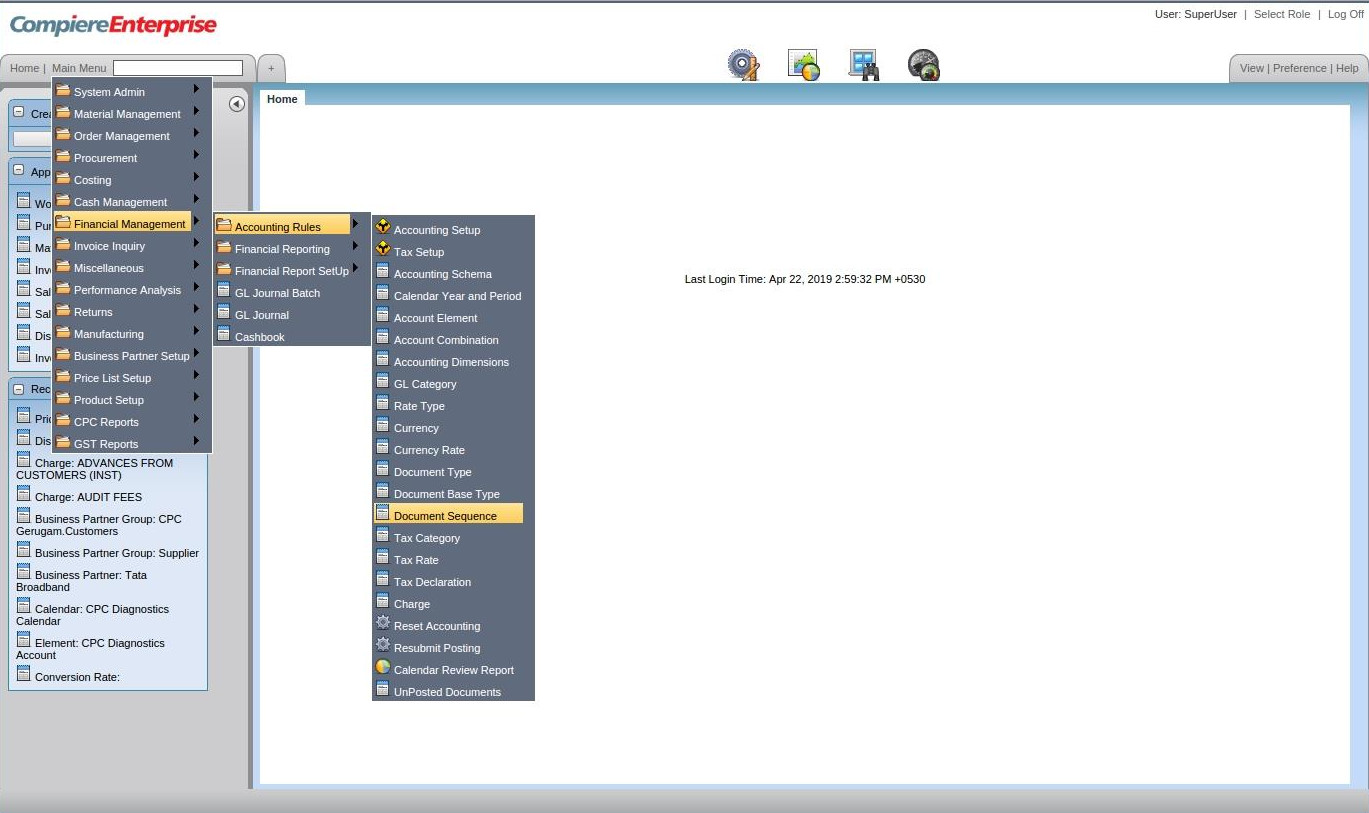

2.3 Currency Rate

Main Menu–>Financial Management — > Accounting Rules — > Currency Rate

Tenant: CPC, Organization: *

From Currency: To Currency (Any other Currency);

Valid From & To Date: Need to be defined, Multiply Rate: As per Exchange Rate

The divide by automatically gets calculated

2.4 Document Type

Main Menu–>Financial Management — > Accounting Rules — > Document Type

The Document Type Window defines any document to be used in the system. Each document type provides the basis for the processing of each document and controls the printed name and document sequence used

Document Type for CPC can be Debit Note, AP Creditors, and Other Creditors etc

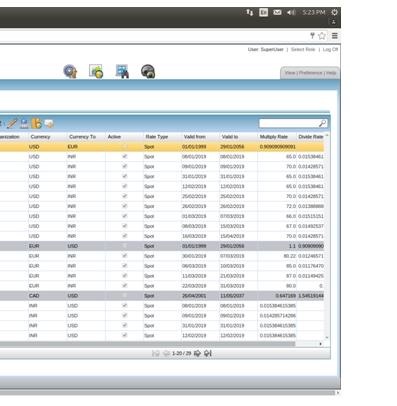

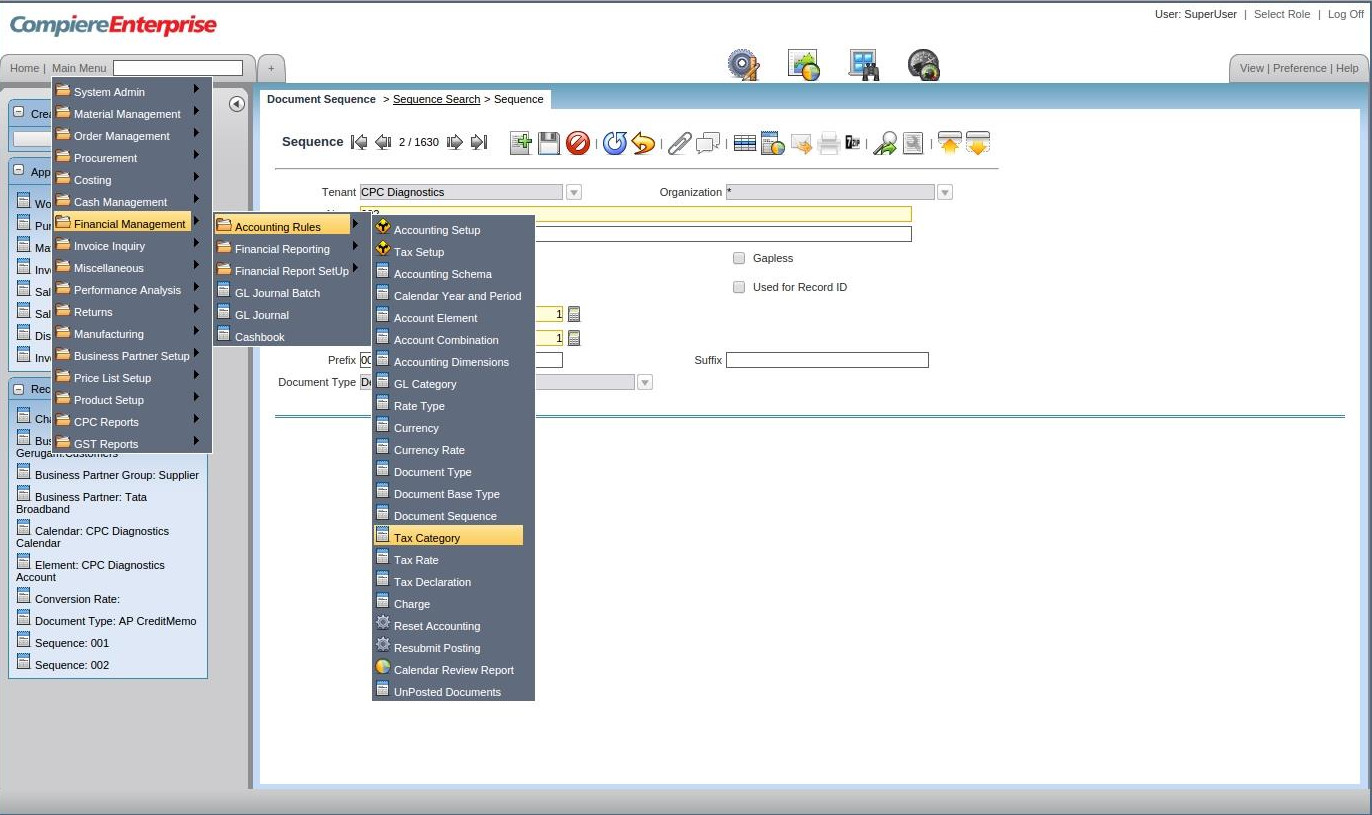

2.5 Document Sequence

Main Menu–>Financial Management — > Accounting Rules — > Document Sequence

The Sequence Window defines how document numbers will be sequenced. For Each Document Type, Prefix & Suffix can be added for various tables

Name, Description, Increment for next number, The Prefix & Suffix can be defined for each document type

Forex: For Chennai Other Creditors for 2019 – 20, AP/CHE/19-20/001

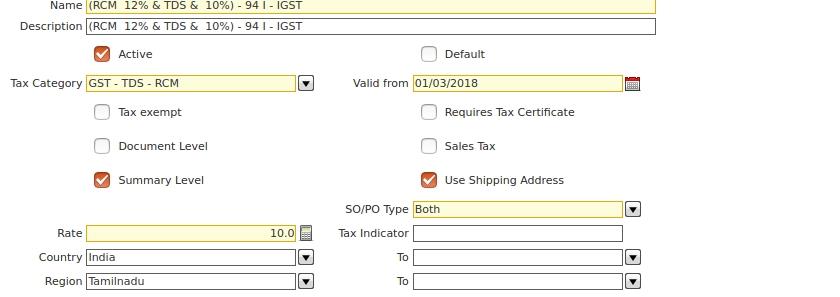

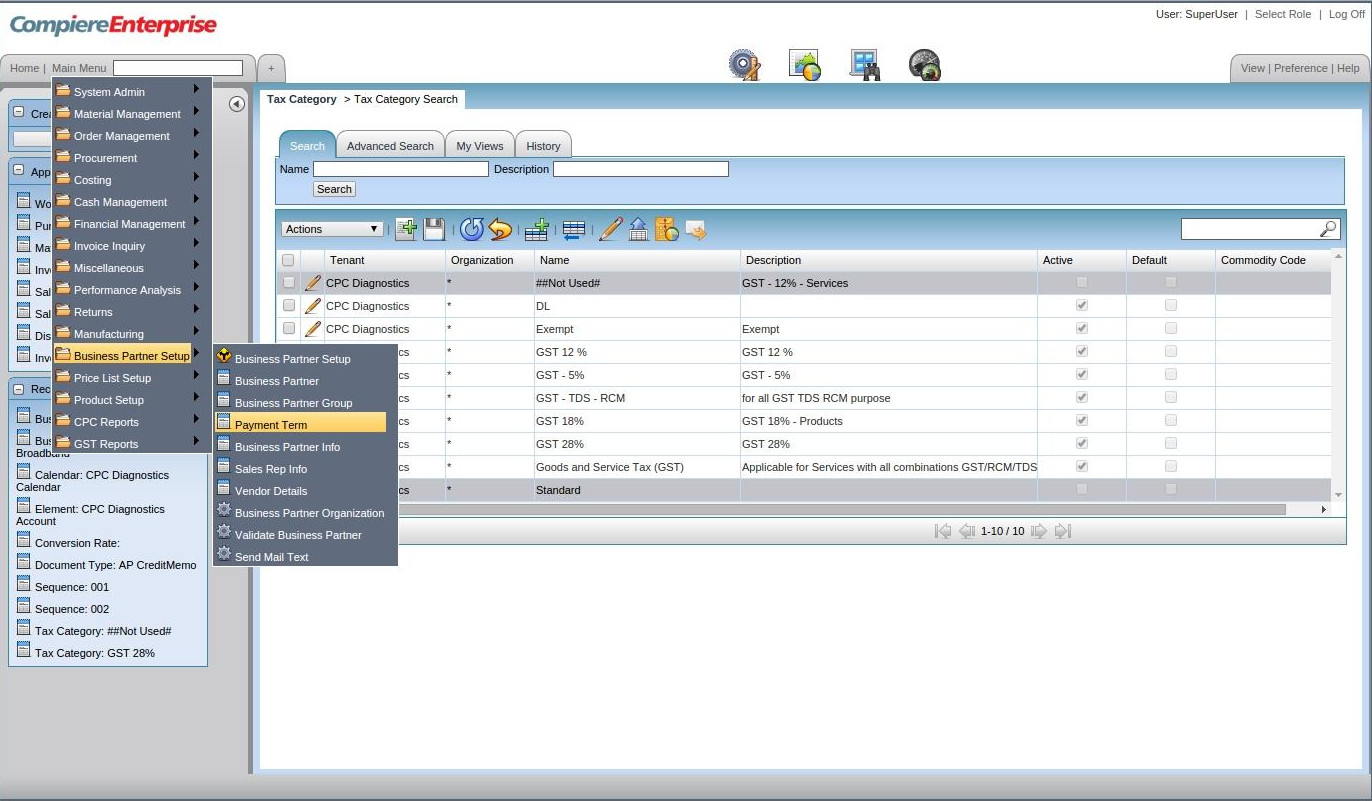

2.6 Tax Category

Main Menu–>Financial Management — > Accounting Rules — > Tax Category

The Tax Category Window is used to enter and maintain Tax Categories. Each product is associated with a tax category which facilitates reacting changing tax rates

Forex: for CPC, Accessories can be taxed at GST of 5% whereas the Fixed Assets can be taxed at GST 18%. Services have a Combination of GST & TDS as well

Hence GST with multiple Rates can be defined in this window

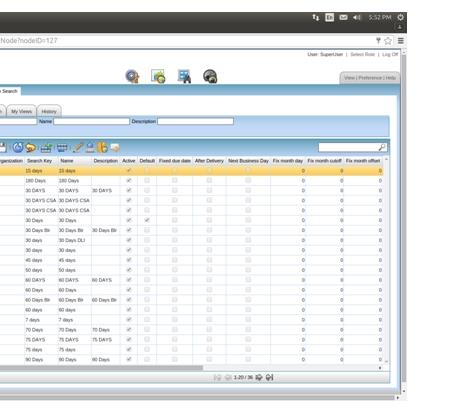

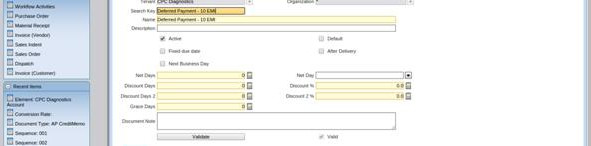

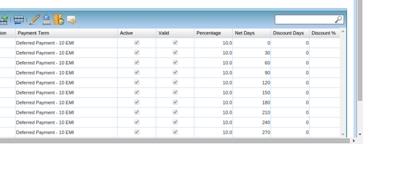

2.7 Payment Term

Main Menu–> Business Partner Setup — > Payment Term

The Payment Term Tab defines the different payment terms that you offer to your Business Partners when paying invoices and also those terms which your Vendors offer you for payment of your invoices. On the standard invoice, the Name and the Document Note of the Payment Term is printed

Search Key & Name to be defined

In Case of deferred payment, the schedule of payment, the number of payments, the no of days of overdue, the percentage of completion needs to be defined as 1 time under the schedule tab

Combination of Taxes

1. Only TDS with various sections

2. Only GST for Products

3. Only GST for Expenses – (same as GST for Products)

4. TDS & GST for Service Invoices

5. TDS & RCM for Service Invoices

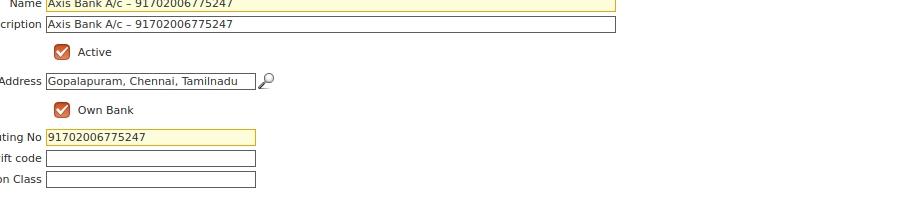

Financial Account

The Financial Accounts can be configured as Bank