53 Steps for Configuration of Taxes – GST & TDS for Services using Compiere ERP

GST is the biggest tax-related reform in the country, bringing uniformity in the taxation structure and eliminating the cascading of taxes that was levied in the past. The GST Council meets from time to time to revise the GST rates for various products. Several states and industries recommend reduction in GST tax rate for various items which are discussed in these meetings

The government has a 4-tier tax structure for all goods and services under the slabs- 5%, 12%, 18% and 28%.

For Services like Consultancy Charges, audits, HR Advisory, Taxation, the Tax Deducted at Source as per Indian Income Tax Act 1961 will also be applicable

Tax Deducted at Source (TDS) is a system introduced by Income Tax Department, where person responsible for making specified payments such as salary, commission, professional fees, interest, rent, etc. is liable to deduct a certain percentage of tax before making payment in full to the receiver of the payment.

Instead of receiving tax on your income from you at a later date, the govt wants the payers to deduct tax beforehand and deposit it with the govt

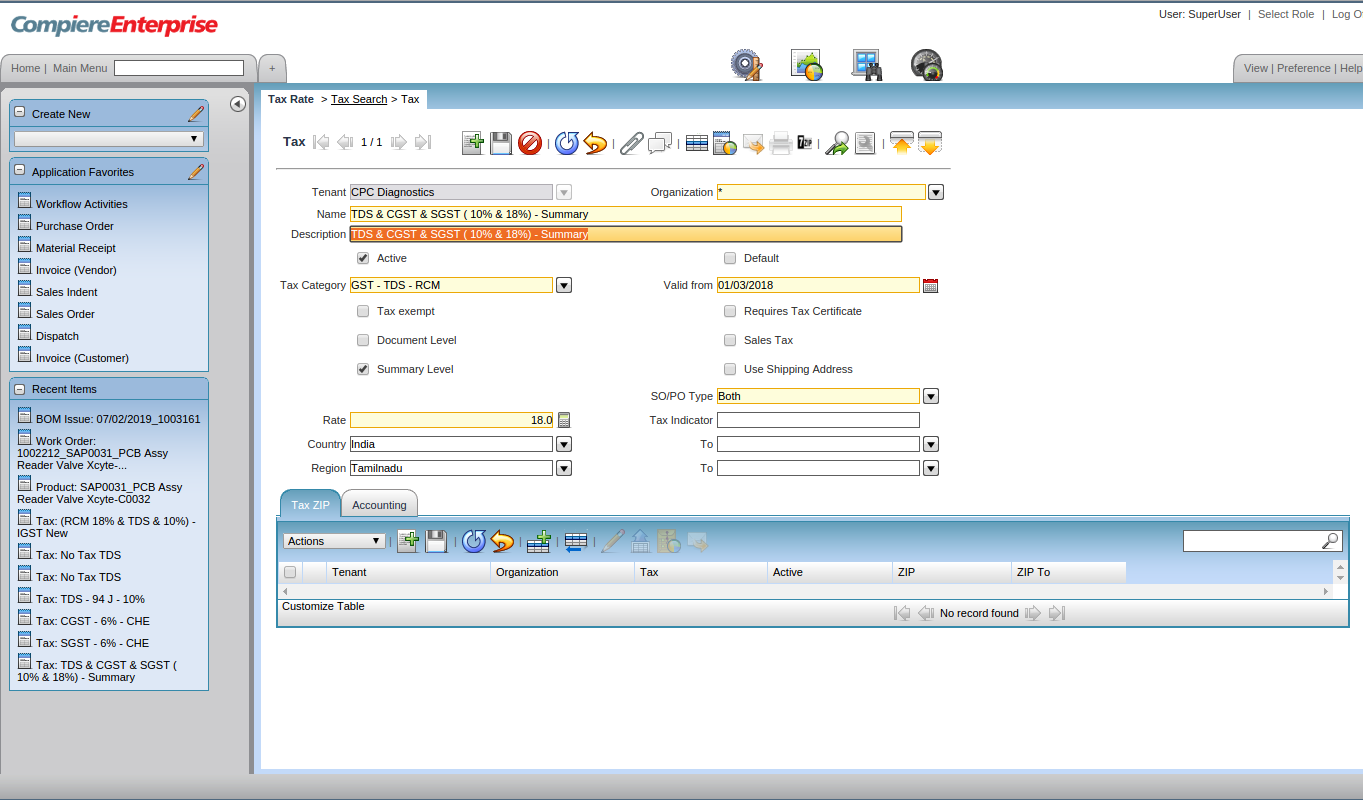

1. Create TDS & CGST & SGST ( 10% & 18%) – Summary

2. Note in TDS & GST Combination, the rate defined @ Summary Level has to be GST Rate only)

3. Tax Category to be selected as GST – TDS – RCM

4. Summary Level check box to be checked

5. Rate to be given as 18 (only the GST Rates to be mentioned)

6. A Valid from Date to be given & saved

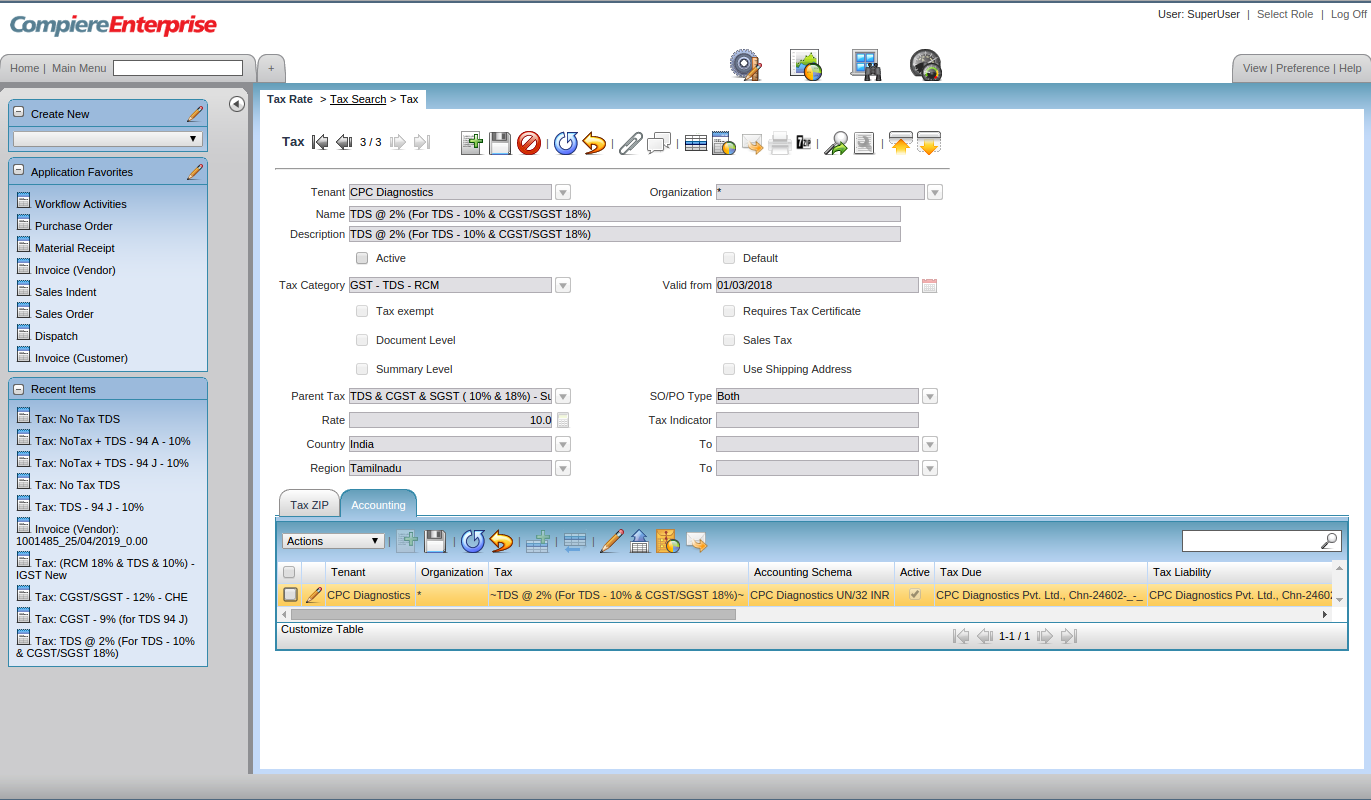

7. TDS @ 10% (For TDS – 10% & CGST/SGST 18%) to be created as normal tax (TDS should be the starting word & no other words like GST/RCM to appear)

8. Tax Category to be selected as GST – TDS – RCM

9. A Valid from Date to be given

10. Parent Tax to be TDS & CGST & SGST ( 10% & 18%) – Summary

11. Rate to be given as 10%

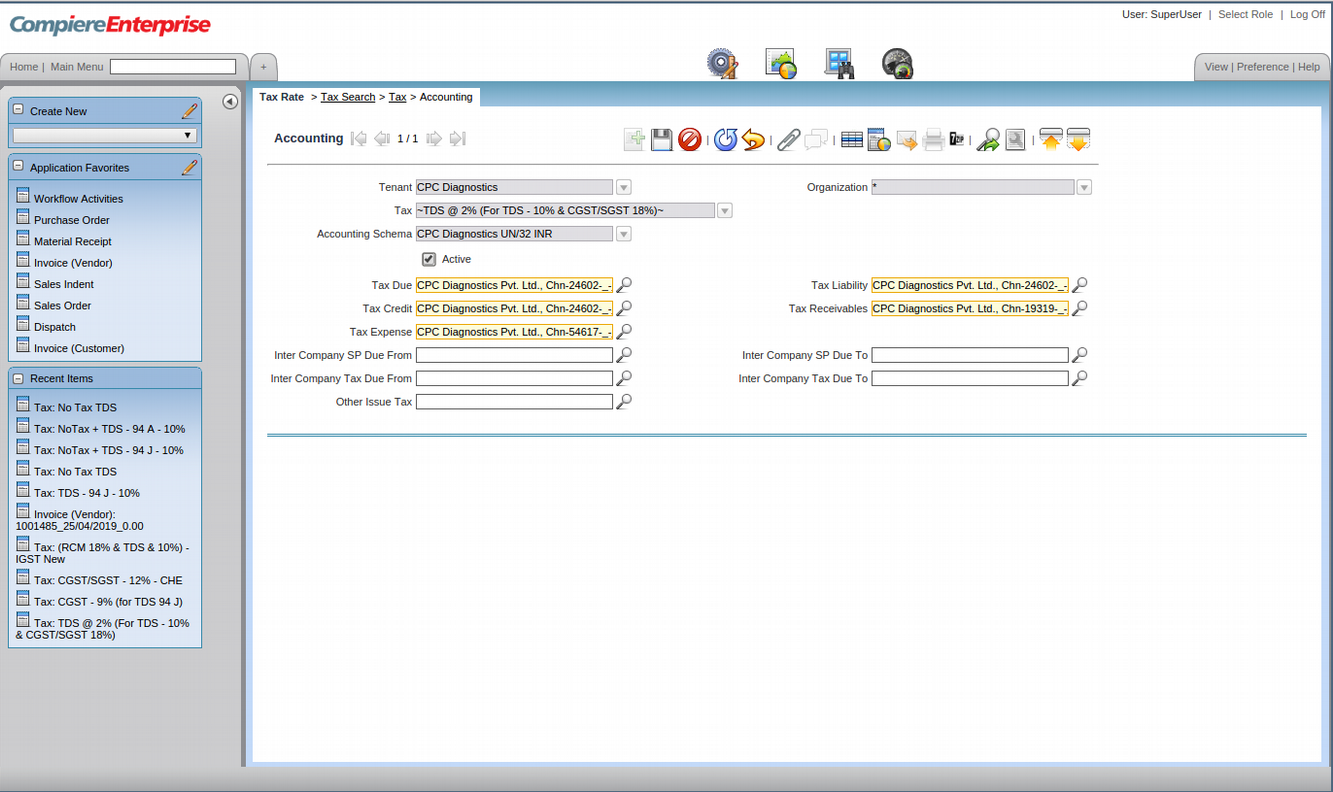

12. The accounting ledgers to be mapped to correct Account element

13. Only the TDS section payable amount to be mapped in Tax Due, Tax liability & Tax credit ledgers

14. Click on the zoom button

15. It will take to the search key window

16. Remove the Organisation mapped in Combination tab

17. In the search key, if the account code is known, then it can be given and entry button pressed to get the account code

18. if account code not known, then in the name tab mention %TDS

19. This will throw all the TDS related taxes and from them the correct tax can be selected

20. Then once again the select has to be clicked in order to map the Organisation correctly by double clicking

21. After mapping the Parent Tax, this has be made inactive

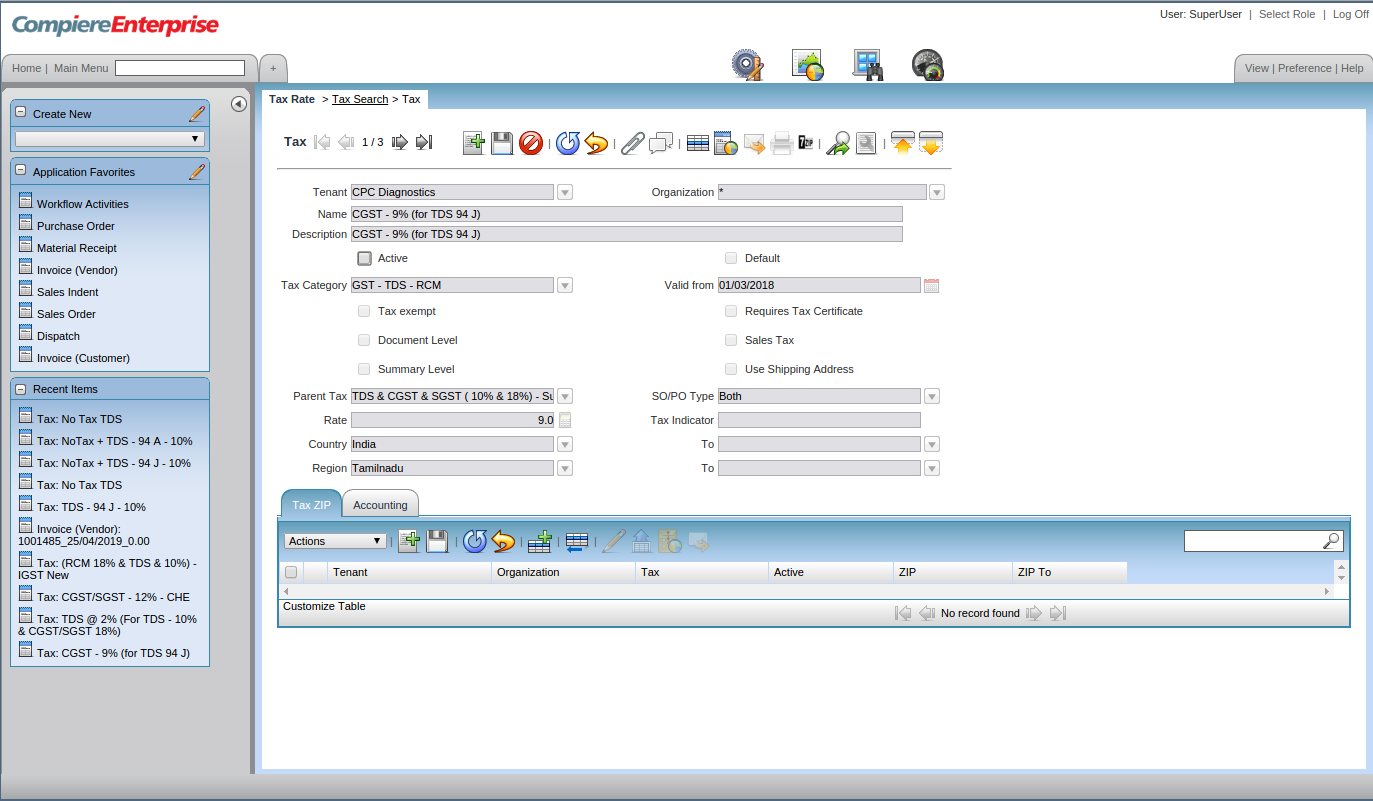

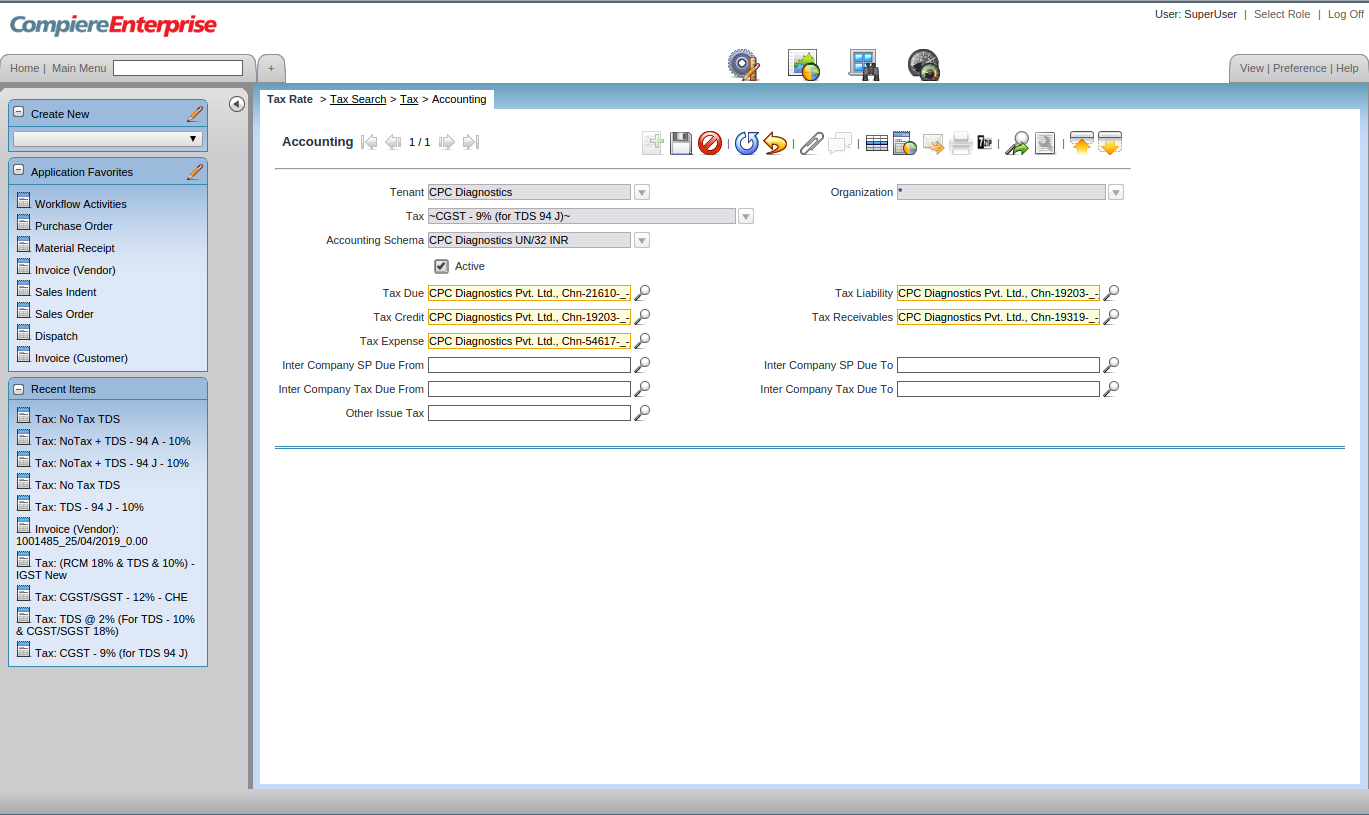

22. CGST – 9% (for TDS 94 J) – CHE to be created as normal tax

23. CGST should be the starting word & no other words like GST/RCM to appear)

24. Tax Category to be selected as GST – TDS – RCM

25. A Valid from Date to be given

26. Parent Tax to be TDS & CGST & SGST ( 10% & 18%) – Summary

27. Rate to be given as 9

28. The accounting ledgers to be mapped to correct Account element

29. After mapping the Parent Tax, this has be made inactive

30. Only the CGST section payable amount to be mapped in Tax liability & Tax credit ledgers

31. Click on the zoom button

32. It will take to the search key window

33. Remove the Organisation mapped in Combination tab

34. In the search key, if the account code is known, then it can be given and entry button pressed to get the account code

35. if account code not known, then in the name tab mention %CGST

36. This will throw all the CGST related taxes and from them the correct tax can be selected

37. Then once again the select has to be clicked in order to map the Organisation correctly by double clicking

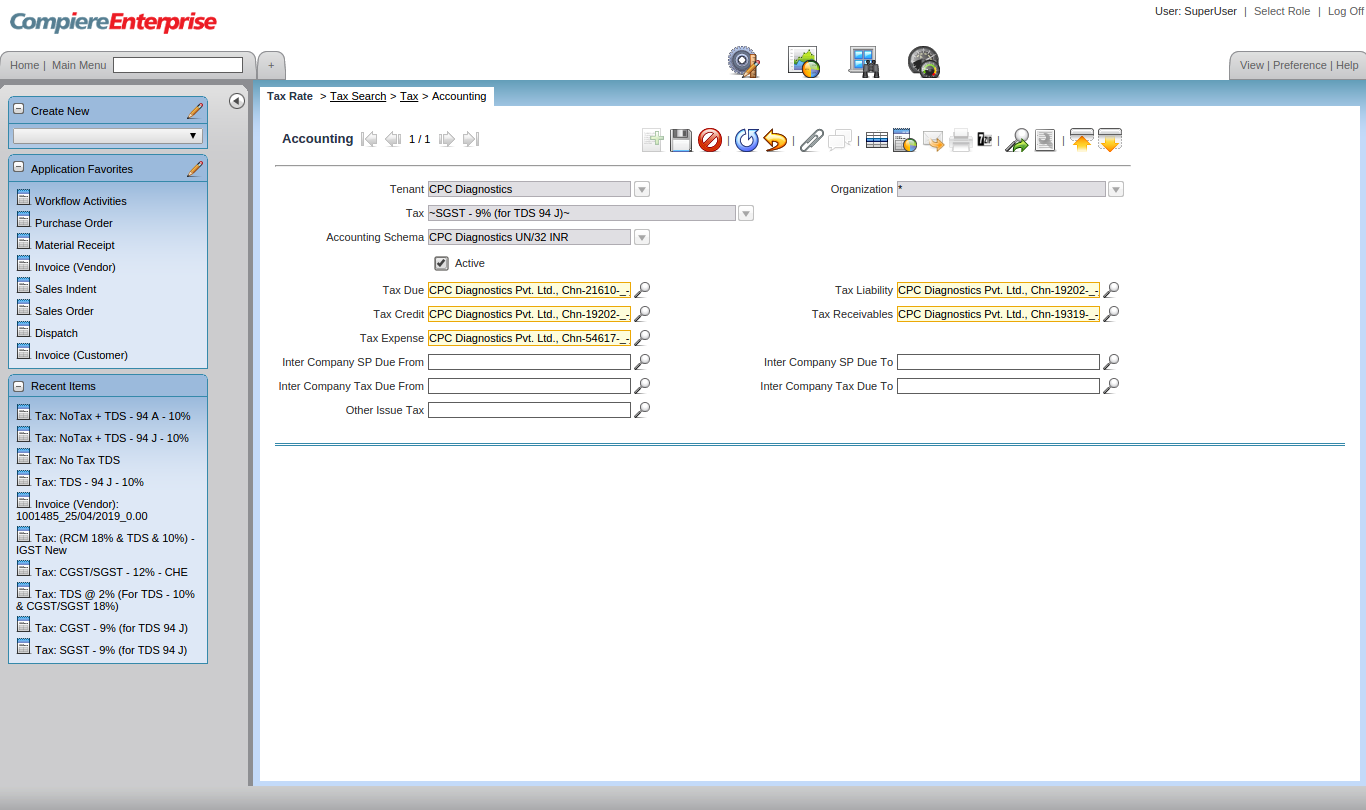

38. SGST – 9% (for TDS 94 J) – CHE to be created as normal tax

39. Tax Category to be selected as GST – TDS – RCM

40. A Valid from Date to be given

41. SGST should be the starting word & no other words like GST/RCM to appear)

42. Parent Tax to be TDS & CGST & SGST ( 10% & 18%) – Summary

43. Rate to be given as 9

44. The accounting ledgers to be mapped to correct Account element

45. After mapping the Parent Tax, this has be made inactive

46. Only the SGST section payable amount to be mapped in Tax liability & Tax credit ledgers

47. Click on the zoom button

48. It will take to the search key window

49. Remove the Organization mapped in Combination tab

50. In the search key, if the account code is known, then it can be given and entry button pressed to get the account code

51. if account code not known, then in the name tab mention %SGST

52. This will throw all the SGST related taxes and from them the correct tax can be selected

53. Then once again the select has to be clicked in order to map the Organisation correctly by double-clicking

Accounting entry for Services with GST & TDS

Example 1: Audit Professional providing GST related consultancy service based out of Chennai. This service has a GST Rate of 18% TDS Deduction of 10% under Section 194 J of Income Tax Act, 1961 for INR 100000

| Particular | Debit | Credit |

| Consultancy Charges Acc | 1,00,000 | |

| CGST Acc – 9% | 9,000 | |

| SGST Acc – 9% | 9,000 | |

| To TDS – 94 J | 10,000 | |

| To Party | 1,08,000 | |

| Total | 1,18,000 | 1,18,000 |

Note : IF the vendor is based in Tamil Nadu & Client also in Tamil Nadu, then only CGST & SGST are applicable. If vendor is based out of Tamil Nadu, then IGST is applicable.